During the HousingWire Spring Summit 2021, David Karandish, CEO and Cofounder of Capacity, spoke in a 20-minute panel on the topic of boosting mortgage profits in a remote environment. At Capacity, multiple mortgage lenders have seen success by implementing our mortgage automation software. This recap article will dive into a few examples of the way lenders can increase profits, save costs, and provide loan officers and borrowers with necessary information.

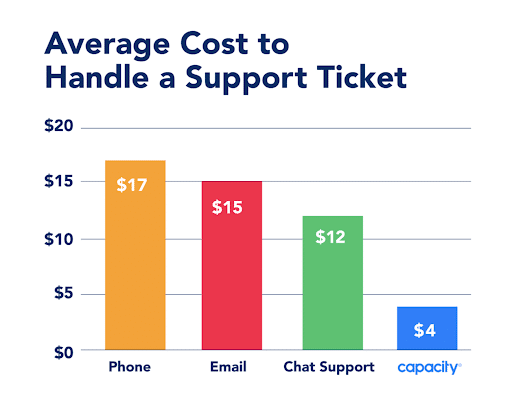

Compare the cost of handling a support ticket and see immediate savings.

One way to boost profits includes reducing expenses. When it comes to handling internal and external questions, the costs add up. Without a mortgage automation platform, there often are multiple steps, resources, and dedicated time that goes into answering borrower questions in any size organization. However, David explained that AI and automation can reduce the cost per ticket to $4. This is significantly lower than the cost to handle a ticket by phone, email or chat support, which could be as much as $17/ticket.

Use AI and automation to supplement remote environments.

“Working from home is here to stay,” said David. “People have learned how to work from home at a high level of excellence, so centralizing your knowledge base is an essential need for mortgage companies.” Gone are the days of walking over to a teammate in the office to ask questions. Instead, team members need a centralized place to ask questions.

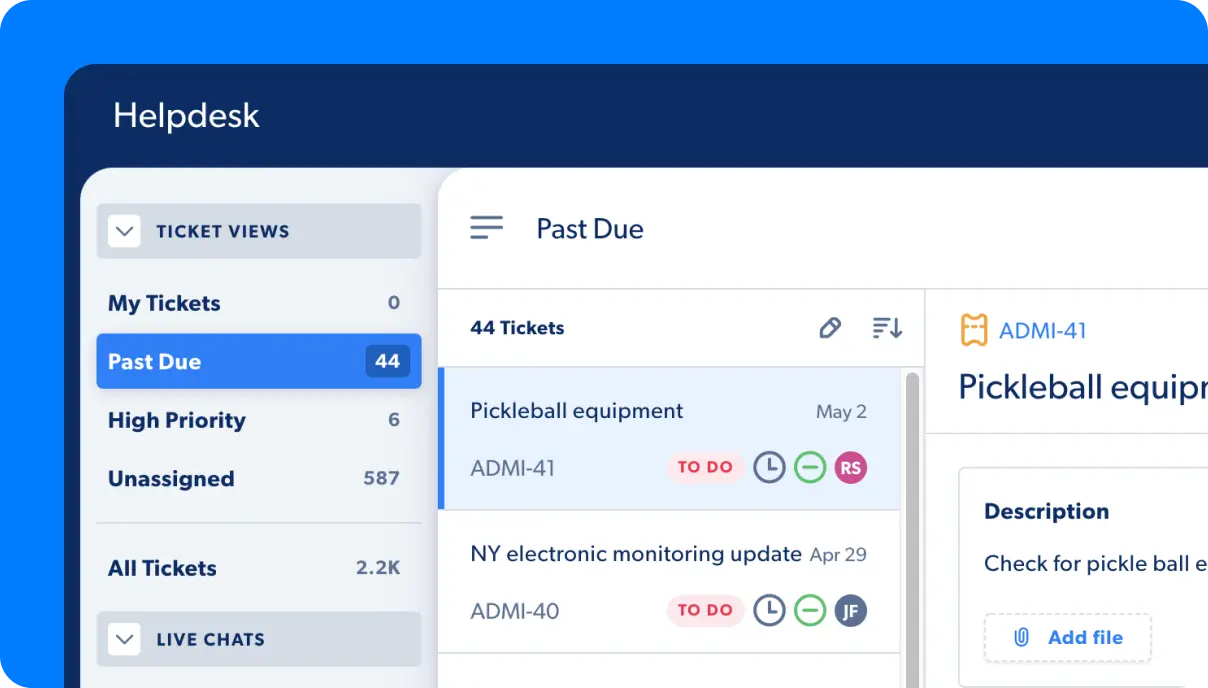

By applying an AI-powered helpdesk, lenders can empower team members with instant access to information. Providing easily accessible information makes everyone’s job easier, which helps with employee retention and reduces turnover costs. An AI-powered helpdesk also keeps leadership informed on the pulse of the organization. By monitoring the incoming questions that team members ask the helpdesk, they can jump into action when they see what their team needs help with. Bottom line, reducing turnover with instantly accessible knowledge is just another great way mortgage companies can save costs and boost productivity.

Improve borrower education and the overall experience.

“Homebuyers aren’t only looking for loans between the hours of 8 and 5 during the workweek,” shared David. It’s critical for lenders to provide borrowers with instant and easy access to information about buying a home at all hours of the day and on weekends. Placing an AI-powered chatbot on a customer-facing website means borrowers have 24/7 access to answers for all their important, top-of-funnel questions.

In addition to providing borrowers with instant answers to their questions, AI-powered bots can take an inquiry and route that lead to the best loan officer based on their needs. Having automated livechat installed on your site gives you an instant communication channel with your leads and borrowers. When borrowers get quicker responses, they’re instantly more satisfied with their experience.

How do these use cases translate to a profitable business?

“AI and automation enable lenders to stop spending time searching for information and take a step back and look at the data so they know where to spend their time,” explained David.

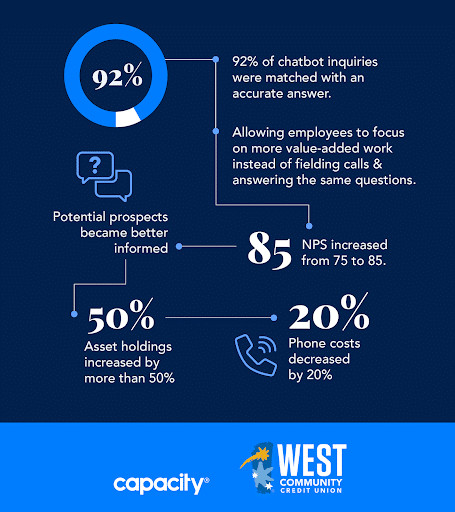

Capacity’s customer, West Community Credit Union (WCCU) has had great success. After implementing the AI-bot, the WCCU team received feedback from the people who interacted with it, whether they got the answer they needed or not. What they found initially was about 50% of the time, customers got what they needed. Over the last couple of years, that number grew to 92%. And, the AI is now directing the WCCU team on how to organize content, where to place it, and what to emphasize on the website to improve the overall borrower experience.

WCCU continues to learn how its members and consumers think as they visit the website to find information. With insight from the AI, WCCU continues to adapt and can now better direct its members to the information they’re looking for. Further benefits are outlined in the infographic below.