Conversational AI makes it possible to have a smooth banking experience even on a busy weekday morning. Instead of spending hours trying to find one piece of information, you can now ask an AI chatbot for the answer. The intelligent chatbot can quickly understand and resolve your issue within seconds. Sounds too good to be true, right?

As time becomes more valuable and customer expectations soar, financial institutions turn to conversational AI and AI chatbots to optimize operations and enhance customer experiences.

In this article, we’ll explore the world of conversational AI in banking, its benefits, trends, use cases, and how it can impact your organization. Let’s get started!

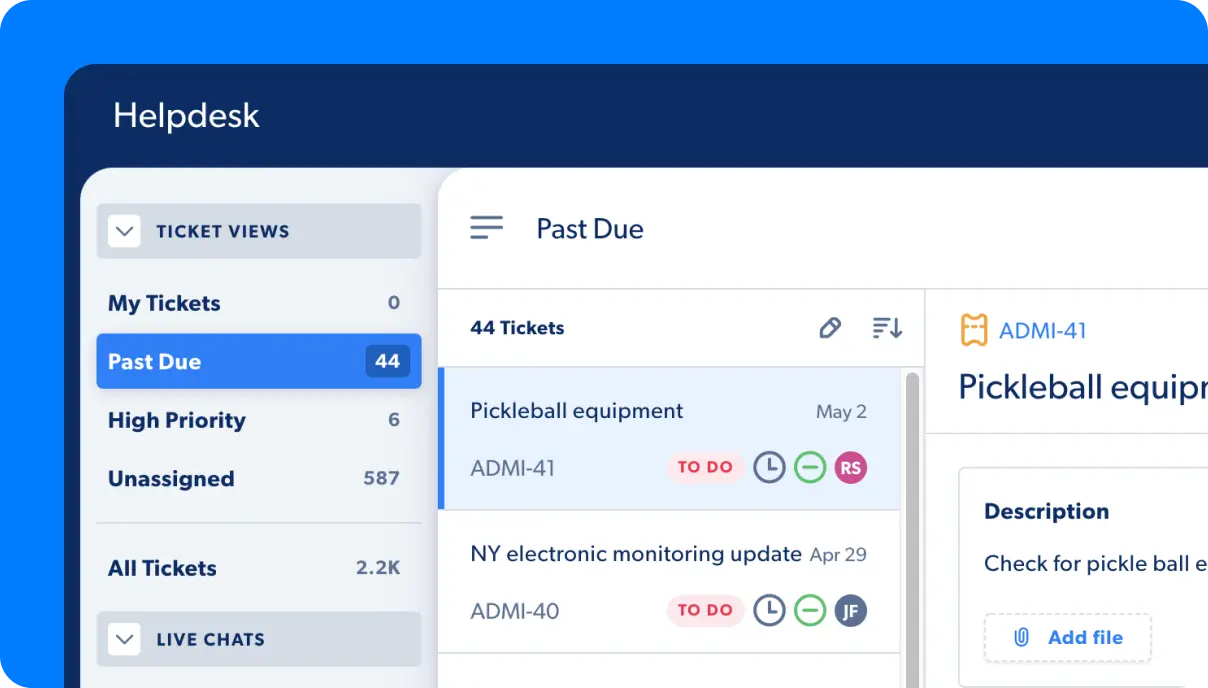

Automate Your Work

Capacity’s enterprise AI chatbot can help:

- Answer FAQs anytime, anywhere

- Find relevant documents within seconds

- Give surveys and collect feedback

What is conversational AI in banking?

In a nutshell, conversational AI refers to the use of intelligent chatbots that can communicate with customers and employees through natural language processing (NLP), machine learning, and other advanced technologies.

Picture this: instead of waiting in long queues or spending hours on hold with customer service, you can simply chat with an AI-powered bot who’s always available to help, 24/7. Conversational AI in banking is all about creating a seamless, intuitive, and personalized user experience while taking some of the load off customer support teams.

Both internal teams and external customers can benefit from conversational AI in banking. Let’s take a look at a few of the top benefits.

Top benefits of conversational AI in banking

Let’s explore some of the fantastic perks that conversational AI brings to the banking world:

Improved customer experience

Tired of robotic, impersonal interactions with your bank? Conversational AI can make those a thing of the past. AI chatbots can handle various tasks, from account balance inquiries to loan applications, providing quick and accurate responses that feel like you’re chatting with a knowledgeable human.

Cost savings

Time is money, and conversational AI has your back for both! With AI chatbots handling everyday tasks, customer support teams can shift their focus to more game-changing projects. This helps streamline banking operations and cut costs at the same time.

Enhanced security

Conversational AI in banking also helps make your accounts more secure. AI chatbots can detect and flag suspicious activity in real-time, helping prevent fraud.

AI automation platforms like Capacity offer a comprehensive knowledge-sharing system with a permissions structure that can accommodate any complexity a bank has in its information architecture.

Streamlined internal communication

Conversational AI isn’t just for customers – it can also be used internally to improve communication between employees, answer HR-related queries, and even provide instant updates on critical business metrics.

See how Capacity’s HR team uses the Capacity platform to automate tedious tasks!

24/7 availability

AI chatbots don’t need breaks or time off, unlike human customer support representatives. They can provide uninterrupted service around the clock, ensuring that customers have access to the support they need whenever they need it.

Multilingual capabilities

In our increasingly globalized world, the aptitude to communicate with customers in their native languages is invaluable. Conversational AI chatbots can be designed to support multiple languages, allowing banks to cater to a diverse customer base and enhance the overall user experience.

Conversational AI trends in banking

Discover some of the latest trends in conversational AI:

- Omnichannel integration: Customers today want a seamless experience across multiple touchpoints, and banks are responding by integrating AI chatbots with various communication channels, such as social media platforms, mobile apps, and websites.

- Voice-assisted banking: With the rise of voice-enabled devices like Amazon Echo and Google Home, banks are jumping on the bandwagon and investing in voice-assisted chatbots to cater to this growing demand.

- Advanced analytics: Banks use advanced analytics capabilities to gain deeper insights into customer behavior, enabling them to personalize their services and predict customer needs more accurately.

- Regulatory compliance assistance: Navigating the complex regulatory landscape can be a headache, but AI chatbots are here to help by providing real-time updates on compliance requirements and assisting with risk management.

- Collaborative problem-solving: AI chatbots are now designed to work collaboratively with human customer support representatives. By quickly providing relevant information and suggestions, these chatbots can help human agents resolve customer issues more efficiently, resulting in quicker response times and higher customer satisfaction.

- Proactive customer engagement: Conversational AI is moving beyond reactive support and towards proactive engagement. AI chatbots can now predict customer needs and offer timely assistance, such as sending reminders about upcoming bill payments or notifying users of relevant promotions and offers.

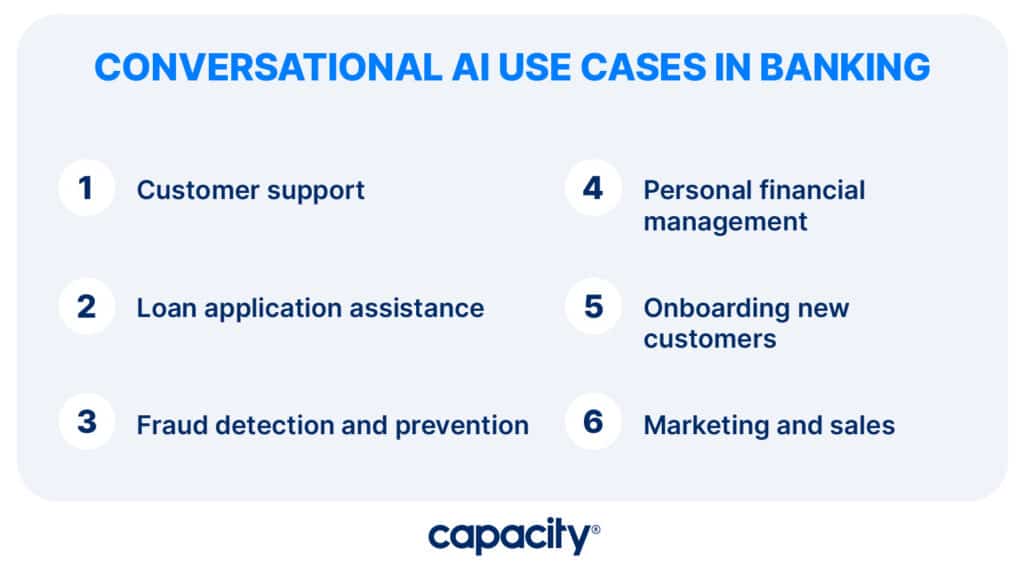

Conversational AI use cases in banking

Now that we’ve covered the basics, let’s dive into some of the most compelling use cases for conversational AI in banking:

Customer support

Banks can use the power of conversational AI to improve customer support in a number of ways. AI chatbots can provide swift and accurate responses to customers’ inquiries, allowing them to find answers quickly and easily without waiting on hold or contacting a human customer service representative.

Conversational AI also helps create a more engaging user experience, as AI chatbots can understand the nuances of natural language and provide personalized responses tailored to each customer’s needs. Banks can also use conversational AI to streamline operations and reduce costs by freeing up customer service teams from mundane tasks so they can focus on more critical projects.

Loan application assistance

Applying for a loan can be disheartening, but AI chatbots can make the process a breeze. Customers are guided through by answering questions about eligibility, interest rates, and repayment terms. They can also gather the necessary documentation, making the process more streamlined and convenient for customers.

Fraud detection and prevention

Nobody wants to fall prey to fraud. Thankfully, conversational AI is on your side to prevent it.

By analyzing customer interactions and transaction patterns, AI chatbots can identify suspicious activities and flag potential fraud in real-time, helping banks protect their customers and maintain trust.

Personal financial management

Need a virtual financial advisor? AI-powered chatbots can offer customized budgeting tips, savings recommendations, and investment advice. This is all based on the customers’ financial goals and risk tolerance, making personal finance quick and easy for customers.

Automate Your Work

Capacity’s enterprise AI chatbot can help:

- Answer FAQs anytime, anywhere

- Find relevant documents within seconds

- Give surveys and collect feedback

Onboarding new customers

First impressions are crucial. Conversational AI can ensure a positive experience for new customers by guiding them through account opening procedures, product selection, and initial setup. This helps banks quickly onboard new customers and create a great relationship from the start.

Marketing and sales

AI chatbots can analyze customer data to identify cross-selling and upselling opportunities. They engage customers with personalized product recommendations and promotional offers that are just too good to resist.

The future of conversational AI in banking

As you can see, conversational AI is revolutionizing the banking industry, transforming customer interactions, and streamlining business operations. But this is just the beginning. With advancements in AI technology and the ever-evolving demands of the digital age, the possibilities for conversational AI in banking are virtually endless.

The key to maximizing the potential of conversational AI in banking lies in striking the right balance between technology and the human touch. While AI chatbots can handle many tasks, customers will always receive support and guidance from real-life human experts when necessary.

Final thoughts

As we reflect on the potential of conversational AI in banking, it’s crucial to consider the solutions that can assist financial institutions in maximizing this technology’s benefits. Capacity, an AI-powered support automation platform, stands out as a game-changer by connecting the entire tech stack and automating repetitive tasks, thereby transforming the banking landscape.

In an era where AI chatbots and conversational interfaces are becoming increasingly prevalent, Capacity offers a unique perspective on the future of banking. With seamless integration into existing tech stacks, Capacity empowers banks to stay ahead of the curve. With Capacity, businesses can deliver exceptional customer experiences in a rapidly evolving industry. Embracing AI-powered support automation, financial institutions can confidently step into the future of banking.