Innovations in technology mean that lenders can close more loans faster. This article will discuss how task-based workflow platforms like Capacity can streamline everyday processes and boost productivity through robotic processing automation (RPA). However, before we dive into the benefits of task-based workflows, let’s share some definitions first.

A task-based workflow is a project management methodology that focuses on specific tasks and their sequence. It can be used to efficiently organize business processes, especially those involving repetitive or high-volume tasks such as loan origination, without the need for human intervention with every task. This both reduces labor costs and speeds up operations.

In essence, it’s a set of sequential tasks that empower mortgage companies to complete the loan origination process quickly and efficiently.

How can artificial intelligence supercharge task-based workflows?

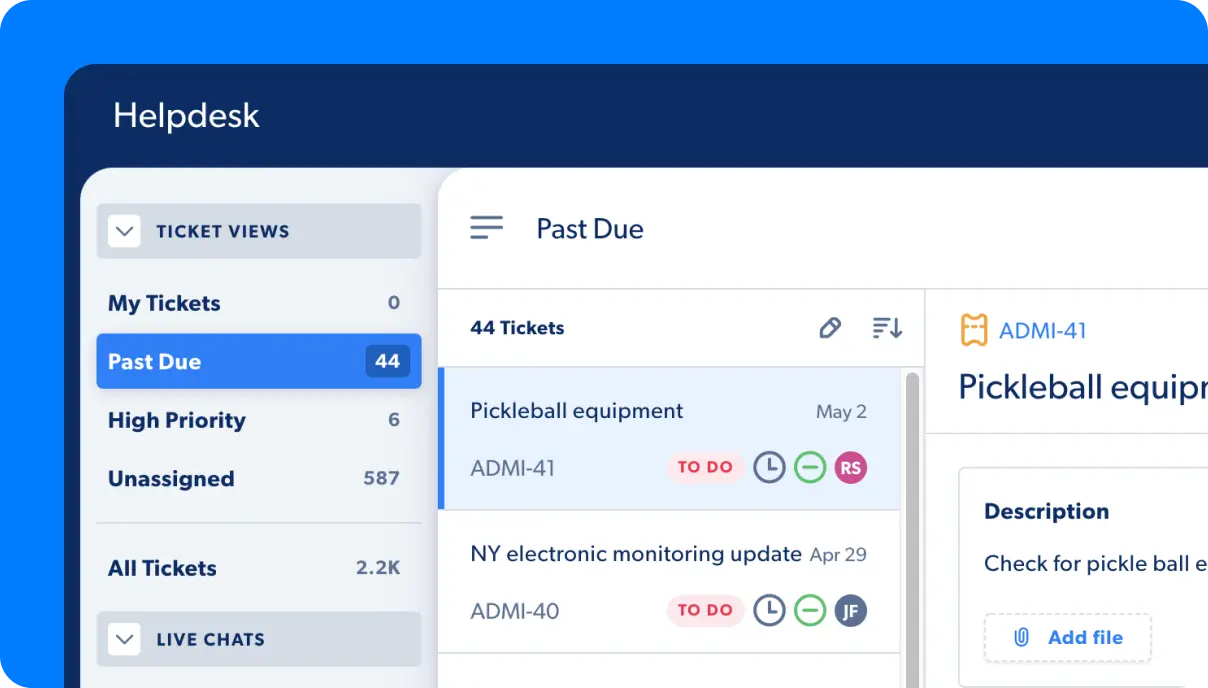

Workflows powered by AI, like Capacity, are built using a combination of human-powered and automated tasks. These workflows can flawlessly execute tasks and prompt human team members when their input is needed.

Here are some of the tasks that workflows can automate:

- Sending emails to borrowers requesting documents.

- Sending reminders when documents are overdue.

- Tracking customer-service task completion rates for different teams and individual members.

- Automatically assign tasks to people or groups.

- Setting due dates, sending notifications, and sharing files within the process.

What are the benefits of a task-based workflow for originating loans?

1. Improving compliance rates.

Successfully processing loans means that loan officers must meet a multitude of complex regulatory requirements. Workflows remove human errors and oversights from the process, keeping mortgage companies compliant.

For example, task-based workflows can automatically send notifications when documents are overdue. Loan officers can also use systems like Capacity to check on complex regulations by asking the software in natural language, rather than wading through a pile of documents or website links.

2. Offering more insight into task completion rates.

Workflows are like a report card for your team’s performance. They can track task completion rates by individual members, teams, and departments, so you know what needs improving. For example, in Capacity, you’ll see a task list with all duties delegated to assignees, the number of tasks completed successfully, and how long it takes for each workflow step.

3. Reducing errors in data entry.

Even when loan officers complete a task 10 times a day, there’s room for error. However, when automating highly repetitive workflow tasks, lenders can eliminate the possibility of human error. Another great benefit of a task-based workflow lies in the fact that it tracks and configures interactions. When there’s a borrower issue, lenders can easily see how many times it was reported and why with the click of a button.

4. Streamlining repetitive tasks via workflows.

Loan officers are often faced with repetitive tasks, such as updating borrower profiles. With task automation, these jobs can be completed in a fraction of the time, reducing repetition and error rates and improving validation.

5. Lessening administration work.

Loan officers have to grapple with new tasks, submit a ton of paperwork, communicate with borrowers, and manage their daily loan management lifecycles. A task workflow simplifies cross-departmental communication, shows where bottlenecks are in the loan process, and can even remind loan officers of tasks throughout their day. Ultimately, making task management part of the workflow results in more successful outcomes for loan officers.

6. Decreasing time training loan officers on technology.

AI-powered management platform tools like Capacity cut down on the need for mortgage companies to train their team on multiple technology platforms. This is because Capacity integrates with apps. Individual users can ask Capacity questions in a tool like Slack or Microsoft Teams rather than logging in and finding the answer on a specialized platform.

7. Improving customer service and experience.

The same task-based workflows that save time and money will also increase the quality of customer service. Loan officers are less likely to make mistakes with routine tasks, which means your borrowers have an easier experience when they call in for help.

Task-based workflows also reduce call volume and speed up the processing time. This means that when borrowers reach out, loan officers can answer their questions quickly, giving them a better chance of retaining your services in the future. Customer service also becomes more transparent with increased reporting and analytics tools.

8. Increasing job satisfaction and employee retention.

Loan officers who work with automation software are less bogged down with boring, repetitive task details. When they are equipped with the tools they need to do their job and close more loans, they’re happier and more likely to stay employed with your company.

9. Focusing on higher-value tasks.

As mentioned before, AI and automation can afford loan officers more time to do the human-centric tasks that matter. These tasks include personalizing their interactions with borrowers, focusing on more complex issues, and offering strategic value.

10. Reducing production costs and increasing profits.

Workflows reduce the likelihood of human error and provide greater stability in terms of output and quality assurance. The better the borrower experience, the more likely they are to return for future services. That means lower production costs and higher profits.

Next steps for your mortgage company.

Task-based workflows and RPA might be innovative now, but they will soon be standard throughout the mortgage industry. To get ahead of the curve, it’s vital to do your research now, so you can close more loans tomorrow.