As a mortgage loan officer, you probably worry less about fielding unique questions and more about answering the same questions time and time again.

Answering questions, even the multitude of varying iterations of the same questions, is a necessary part of the loan process. It makes your clients feel more comfortable with the process as a whole and you as their loan officer. The time it takes to answer each question every time it comes up is what’s unnecessary.

There are many ways to share the knowledge your clients are looking for. That’s why we identified frequently-asked questions and pointed out a few ways mortgage loan officers can automate the answers. So, even if you have to sound like a broken record, you won’t have to waste valuable time providing an answer, which will empower you to close loans faster.

Question 1: What type of loan should I get?

Informing a client of their loan options can be time-consuming if you forget to use the tools right under your nose.

All the knowledge online makes it easy to do two things. The first being, finding content that aligns with your expertise. The second being, sending it to clients as a resource to inform their decision. Once they review your resources, you can step in as the professional and make a recommendation.

Send an email packaged with a few articles (like these from The Mortgage Report and The Truth About Mortgage) that you feel comfortable with. Ask them to report back on the options that appeal to them the most. As a result, they will appreciate the extra effort and thought you put in to help them make a decision.

Additionally, consider writing a thought leadership article of your own that you can share with clients when this question comes up. Prove that your recommendations align with other experts and link what you’ve written with supplementary articles online. Above all, the time it takes time to write the article is worth the thought leader capital it will produce.

Question 2: What’s an FHA loan?

This is a subquestion of the previous question. For instance, you can easily avoid this one altogether by covering it in the recommended resources you provide at the beginning of the loan process. Of course, if you know that the client is not applying for their first home loan, or doesn’t meet the qualifications, you can substitute in articles that are a better match for their situation. Either way, you can avoid answering the question.

Question 3: How big of a down payment do I need?

In reference to the resources in question one, when you ask your clients to choose loans that sound the most appealing it’s like taking your clients through a guided workflow. Once your client looks into the resources that you provided, they narrow down the number of down payments you’ll have to calculate. Ultimately, it eliminates the work you have to do in the end.

For instance, you would only have to provide calculations for the loans a client has an interest in. And you have insight that you can use as a backup plan if anything goes awry because you know the loans your client is interested in.

Question 4: What documents do I need for this loan?

This question is one that you can avoid by anticipating your client’s needs and providing a simple rundown of the types of paperwork they’ll need to complete and submit. Set the tone for your quality of work and set yourself apart from the competition. In the end, you’ll close more loans faster by answering their questions before they ask.

Create a video that describes the paperwork they might need to complete and why it’s needed. Include all the information a client will need to provide, as well as links to loan disclosures, credit authorization forms, letter of explanations, etc., before they even think to ask.

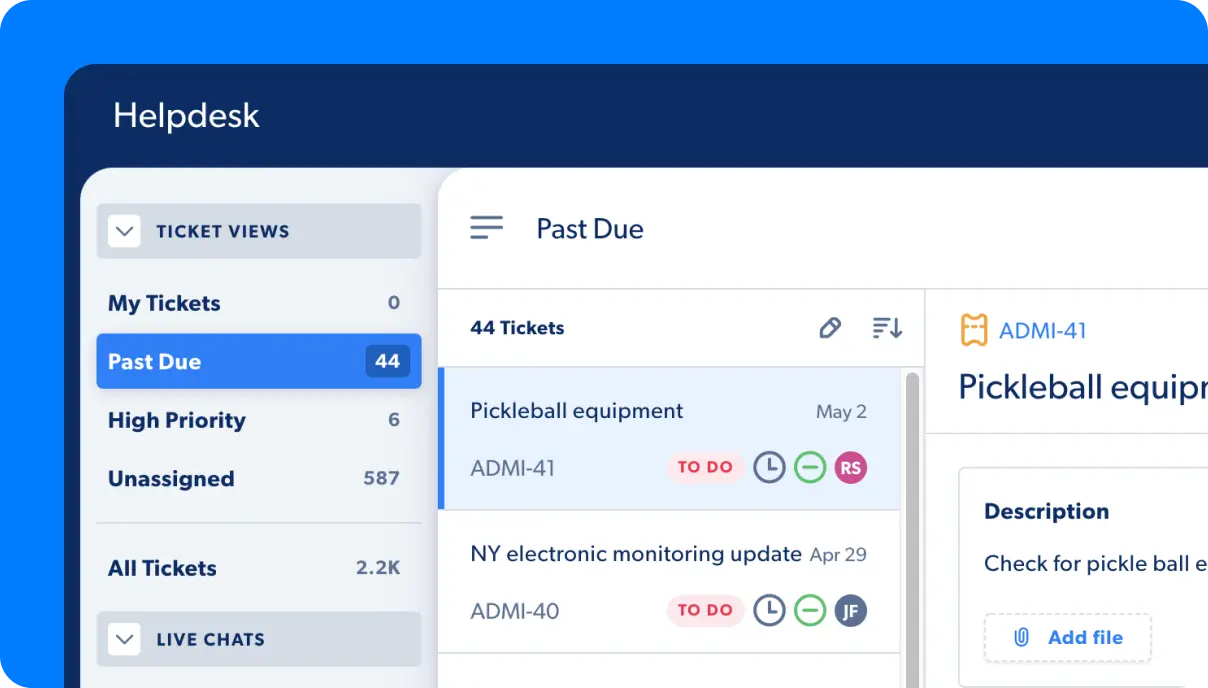

If your organization has a chatbot on the website, you can check if it’s possible to add these details into the knowledge base so you never have to answer the question again.

Question 5: How long will it take to close on this house?

This might be one of the more dreaded mortgage questions for both parties involved. The current loan closing period of 30-45 days isn’t appealing to the client or the mortgage loan officer, and questions like this only delay the process. Not to mention, “How long will it take to close on this house?” is a question that can’t ever be answered until the deal is done.

Create a response that you can easily use on a phone call, send in an email, or load into a chatbot’s knowledge base. Include the standard timeframe and how you’re working to shorten that timeline for them. Let them know if you’ll work as their only point of contact through the loan process, or if they’ll have additional resources. Describe how you plan to communicate updates with them, as they might prefer a different communication channel that works better for them. Establishing expectations only makes the process easier.