Determining whether a prospective homeowner qualifies for a loan involves a number of steps and critical decisions. The average time to close a loan was 47 days in 2020. Automated loan decision-making, however, can reduce cycle times without increasing lending risks. Support automation platforms, like Capacity, leverage machine learning functionality to achieve these and other goals for mortgage companies.

What is machine learning?

Machine learning is a functionality of artificial intelligence (AI) that makes decisions based on data. Unlike other automation processes, machine learning can make inferences and see patterns to make decisions on less cut-and-dry topics.

Machine learning can be used to fully automate tasks or augment the decision-making process of a human. With platforms like Capacity, loan officers and customer service agents can request answers and review analytics reports. They can also delegate entire tasks to the automation platform, such as sending emails, answering application questions, and more. With machine learning, the more the platform is used, the more it learns how to answer certain inquiries.

How machine learning is used in the lending process.

In the lending process, automated loan origination means using machine learning to assist loan officers with the loan decision-making process. Mortgage companies can use AI platforms like Capacity to leverage big data and make data-driven decisions throughout the lending process.

Replace scorecards with big data answers.

Traditional loan decisioning uses scorecards to determine loan eligibility. These cards take the following factors into account:

- Credit scores

- Business credit scores

- Tax returns

- Bank records

While this data offers a reasonable picture of a customer’s creditworthiness, it’s far from the total picture. The results are often too strict or too lenient, both of which have consequences for lenders and applicants. Machine learning supplements this data with additional sources to create a more complete picture.

Accessing data from social media and other online sources can be an, inefficient process for loan officers. Instead of spending time pouring over bank statements and other information, lenders can now automate the process by reducing the amount of time required, while increasing the amount of data used to make a decision.

Leverage chatbot functionality for AI-powered help desk support.

The loan origination and underwriting processes can come with a lot of questions. Loan officers and applicants need hands-on resources to navigate the process with confidence.

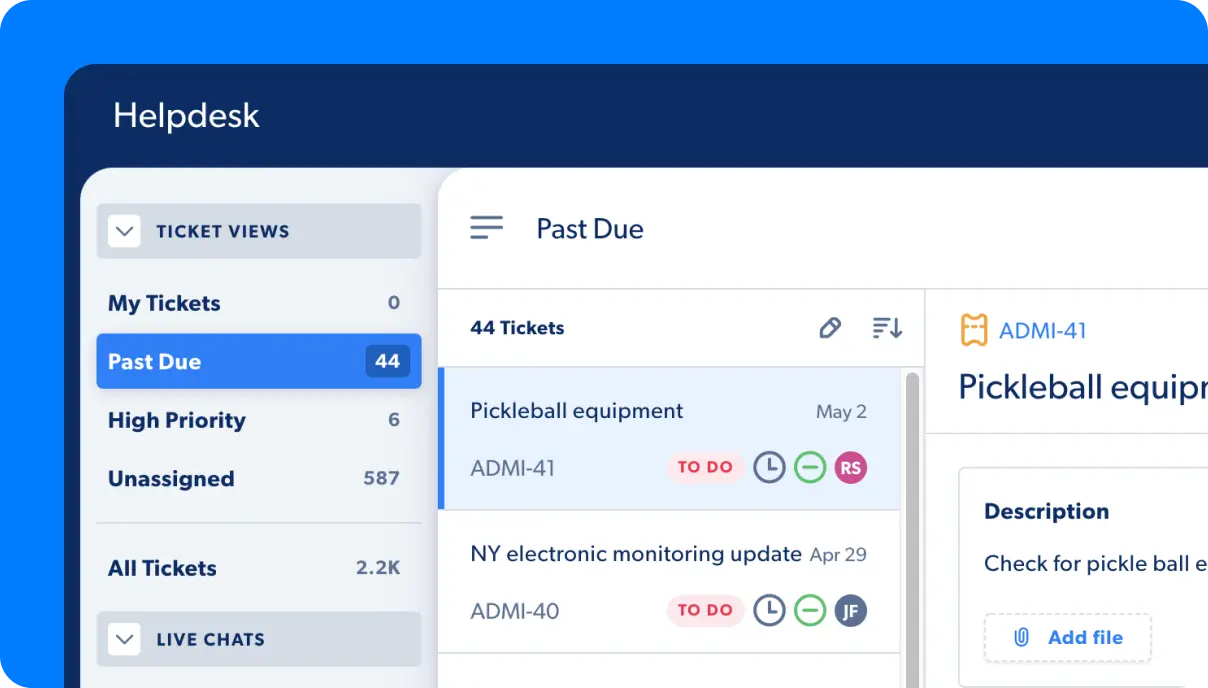

Machine learning totally changes the way help desk support operates. An AI-powered help desk that uses machine learning and chatbot functionality can help your customer support team improve the customer experience. Support automation platforms can provide immediate answers from a broad and customizable knowledge base.

Thanks to this AI-powered functionality, loan officers can receive detailed answers about various tasks as they move through the loan origination workflow. Loan applicants can also receive immediate answers, day or night, without using valuable loan officer time.

Explore the benefits of using machine learning for automated loan origination.

Automated loan origination, eligibility, and help desk support are all combined in platforms like Capacity. Automating support and loan origination can provide the following key benefits.

Reduce operating costs.

A chatbot that utilizes machine learning can field up to 90% of questions from applicants. This can dramatically reduce the amount of time loan officers spend fielding questions, which in turn reduces operating costs.

Another way machine learning can help reduce operating costs is through workflow automation. With new automation technology, you can automatically send out documents to sign and perform other tasks to streamline the loan origination process.

Eliminate unnecessary guesswork.

Modern mortgage companies shouldn’t be resorting to scorecards for loan origination. Capacity harnesses machine learning to help companies get more out of big data. Not only can this platform capture a broad range of information and organize it in a convenient way, but it can also make data-driven decisions throughout the lending process.

Leverage customer analytics during loss mitigation.

Machine learning benefits don’t end after the loan decisioning process. Mortgage lenders can use Capacity customer analytics to determine the best loss mitigation option.

This allows companies to use compliant strategies to determine whether to modify a loan or start the process of forbearance or a short sale. All of these procedures require lots of paperwork and carefully coordinated steps to remain compliant with federal regulations. Machine learning assists loan officers in navigating this process by monitoring the workflow and automated tasks.

Learn more about Capacity machine learning functionality.

An automated loan decisioning platform can field a significant amount of questions, handle diverse tasks and provide detailed customer analytics reporting. Request a demo of Capacity today to see how this support automation platform can provide loan decisioning and customer service solutions.