We sat down with Katherine Campbell, Chief Digital Officer at Assurance Financial, to learn how she has supported the loan officers at her organization with a Capacity and Sales Boomerang integration. In this interview, she shares how to increase a loan officer’s engagement with technology, how to prove an ROI when implementing new technology, and explains other ways technology can benefit mortgage companies.

Why is the Capacity and Sales Boomerang integration so helpful to your team?

“This integration is so important because it eliminates the need for multiple logins and amplifies the use of our current technology,” said Katherine. “By driving alerts with the Capacity and Sales Boomerang integration, loan officers no longer need to open spreadsheets for data or log into multiple systems.”

By using the two technologies together, loan officers enjoy many benefits. First, they can access data on the go with a mobile-friendly interface. Capacity sends the Sales Boomerang alerts directly to the loan officer’s mobile device right when they occur, so they’re always up-to-date wherever they are. A second benefit involves single sign-on (SSO) technology, which empowers loan officers to utilize technology without logging into multiple systems.

“If someone lists their house for sale, Capacity will alert the loan officer of that listing, share information about the seller including their name and phone number, and the loan officer can click the prospect’s phone number to follow up with them regarding their plans to help them secure a free quote for their next home,” explained Katherine.

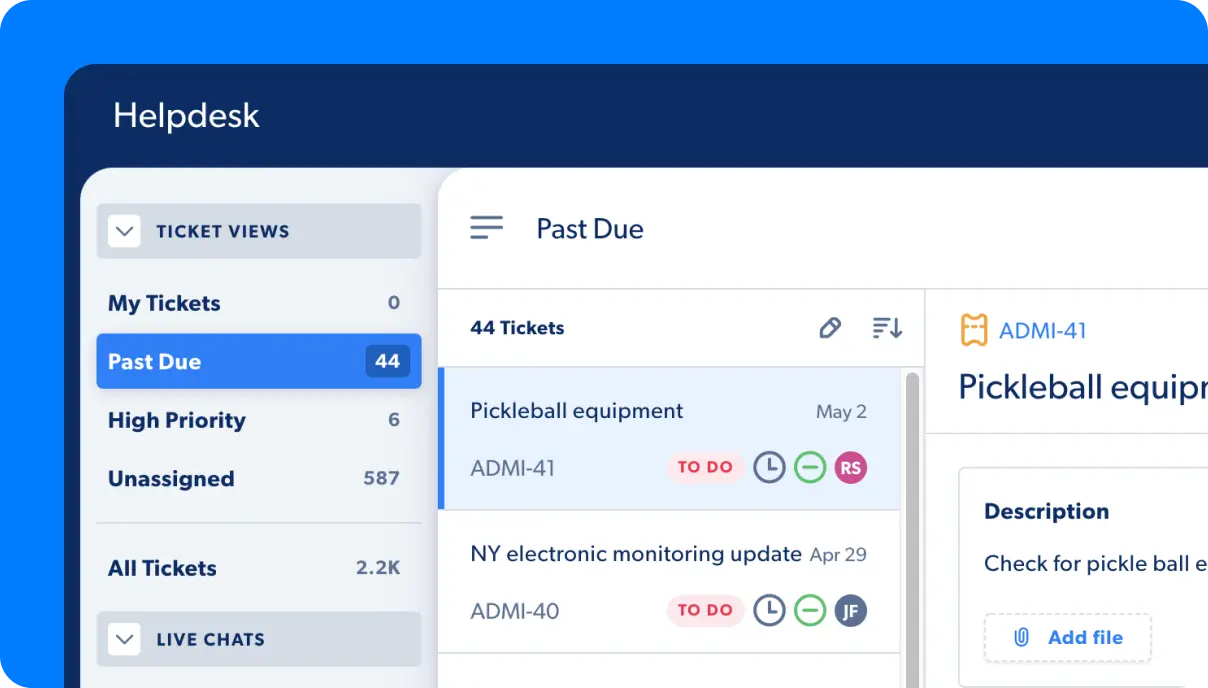

Whatever the scenario, Capacity explains the Sales Boomerang alert type, presents information about the borrower, and shares that information with the loan officer in a very user-friendly interface, so the loan officer has all of the information they need to properly reach out.

How did you realize the value of the integration?

Assurance Financial currently works with 24 different technologies, and Katherine knew that she wanted to help her team of loan officers better utilize Sales Boomerang because of the value it provides. Her goal was to inspire her loan officers to use Sales Boomerang by helping them get more value out of it. “As the CDO, it’s my job to create an experience worth using and great customer service,” Katherine said.

By integrating Capacity with Sales Boomerang, loan officers get all the value out of Sales Boomerang without ever logging in. All the information they need from the tool gets delivered directly to them in an easy-to-use format. This is helpful for loan officers and the company as a whole.

“The number one issue that will come out of 2021 and 2022 is going to be proving the ROI of technology and ensuring that everyone is using it,” shared Katherine. “There will be fallout agreements if these tools aren’t properly utilized because mortgage companies can’t justify it if no one is using the tech.”

Capacity not only makes it easy for loan officers to use Sales Boomerang, but it also tracks chat engagement to know what questions loan officers are asking the most. Capacity makes it easy for mortgage companies to identify which answers are coming from Sales Boomerang.

Why is this integration important in the mortgage industry?

“This integration is beneficial because it provides justification and insight into the ROI of technology,” explained Katherine. “In the mortgage industry, it’s hard to convince everyone to change. But, if you understand that the easiest way to make money comes from the fastest route to selling a loan, then you can realize that technology only speeds up that process and makes it easier to prove that technology is necessary.”

Katherine dove deeper into her explanation, “In the mortgage industry, we don’t make money until the loan is closed and we can start earning on interest. By identifying opportunities faster, we’re gaining money faster.”

Essentially, the Capacity and Sales Boomerang alerts enable loan officers to become aware of opportunities faster and act on those opportunities faster, which means lenders can start making money faster.

Outside of this integration, how do you see your team benefiting from integrations?

“As the CDO, I would like to continue eliminating the non-revenue generating tasks by automating them with Capacity, so our team has more time to focus on revenue-generating activities,” said Katherine. By proving that technology is helpful in one area, it’s easier to get buy-in, adoption, and cooperation to roll out additional initiatives like:

- Marketing automation, which would typically require staff to manually update the status of clients.

- Integrating with HRIS technology to eliminate the need for managers to manually track time or for loan officers to manually clock in and out.

- Integrating with a CRM and setting up alerts to inform sales when an ebook is downloaded, so they can follow up immediately.

“The goal is to create a single source to access everything to make our employees’ lives easier,” shared Katherine.