The Capacity team traveled to Anaheim, CA to attend California MBA’s Mortgage Innovators 2022 Conference. Implementing new technology solutions is a crucial step for any business in the mortgage industry. Our team attended several innovative sessions that provided key information lenders, underwriters, and loan officers can learn from.

Here are a few of our favorite sessions and events:

Rise of the Bots Panel

Capacity CEO David Karndish joined Mohammad Rashid, Tavant, and Greg McElroy, AmeriHome Mortgage, on the Innovation Stage to discuss all things related to robotic process automation (RPA), and how teams can use automated workflows to scale.

In a nutshell, RPA technology uses virtual robots to perform automated steps repetitively at a high volume. RPA streamlines your workflows, completing tasks without any human intervention. Processing a loan entails accurately answering hordes of both customer and loan officer questions, all while meeting a multitude of regulatory requirements. Workflows will take the errors out of the process, keeping you compliant.

Using Automation to Streamline the Mortgage Industry

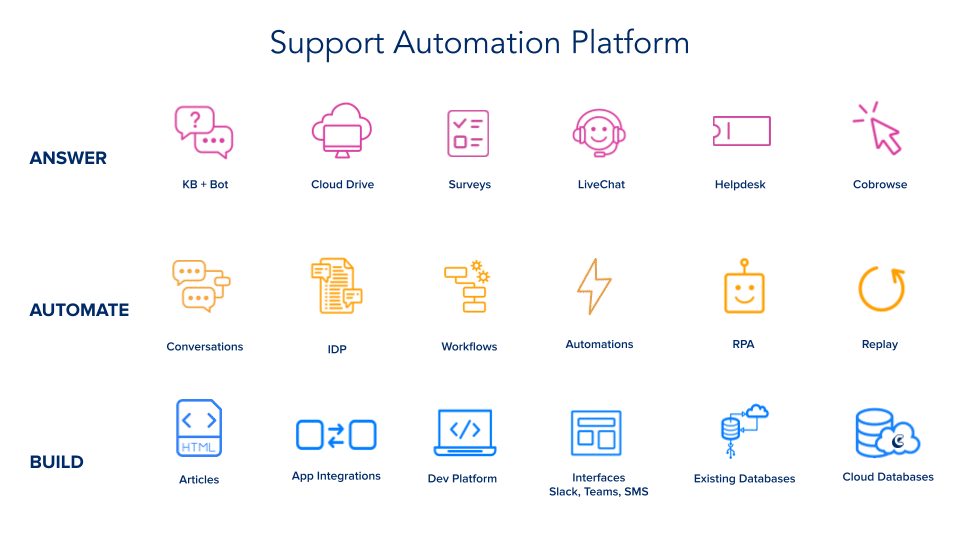

The future of the mortgage industry lies with AI and automation technology. David Karandish talked about how AI and automation can help businesses answer questions, automate repetitive processes, and build new solutions as they grow and expand.

During the session, David hit on a few main points, including:

- What a support automation platform is – software that takes on human labor (Automation) while learning and applying patterns (AI). It can be applied both externally facing for borrowers and internal facing for LOs, underwriters etc.

- Companies like Amerisave, Assurance Financial and West Community Credit Union are using support automation to answer first-time home buyer questions, automate their intranet, answer guideline questions, connect to key applications like LOS and CRMs, mine documents, and intercept emails. They are seeing huge ROI from this software and are using it as the backbone of how they scale and automate.

Support automation is helping businesses automate over 96% of all inquiries 24/7/365, without any human involvement within 1.6 seconds, freeing up time for relationship building and revenue generating activities.

Capacity Live Demo

David Karandish presented a live demo of the Capacity platform, giving audience members the chance to see support automation in action.

Capacity is an industry leader in support automation. Mortgage clients leverage Capacity to automate over 90% of the manual, repetitive questions hitting their operational teams like scenarios, processing, underwriting, lock desk, compliance and customer support. We help our clients defect low value tasks from their high value resources.

Missed the demo? No worries. Watch a Capacity demo here!

Stuck on the sidelines? Tweak your tech stack.

Alex Kutsishin, Sales Boomerang, breaks down the top two things mortgage companies need to do in order to stay ahead in today’s market – speed and execution.

From shifting markets to margin compression, it’s important for companies to prioritize technology implementation. Making sure your team is onboard and open to new technology is a vital step in the process.

Axis Lending Academy Champagne Reception

Our team enjoyed drinking champagne and learning about Axis Lending Academy’s mission – bridging the Diversity, Equity & Inclusion gap through education.

Axis is a non-profit training and education organization that promotes diversity inclusion by increasing your corporate social responsibility, diversifying your team, and impacting your bottom line.