On December 2, HousingWire is hosting a webinar that will feature our CEO, David Karandish, Sales Boomerang’s CEO, Alex Kutsishin, and Assurance Financial’s Chief Digital Officer, Katherine Campbell. In the webinar, these leaders will discuss how mortgage professionals can use tech to stay focused on borrowers’ needs throughout the life of a loan.

This panel will be so impactful because it will highlight the relationship between a mortgage lender and technology vendors. By displaying how they work together to provide a positive borrower experience, attendees can discover best practices for vendor-partner relationships as well.

Featured Companies.

Assurance Financial is a mortgage company that was founded almost 20 years ago in 2001. Since then, they’ve been on a mission to do more than help borrowers buy a home by fostering a community. That has led them to provide a simpler loan process by relying on the latest technology. The company prides itself on its customer satisfaction ratings, comprehensive approach to lending, a wide range of loans, and versatile application process.

Sales Boomerang is the first fully-automated borrower intelligence system that aims to bring relationships back to the lending experience. By providing lenders with borrower intelligence, lenders always know exactly when potential borrowers are ready for a loan, so the relationship is never forced.

Here’s how it works:

Lenders get notified by Sales Boomerang when anyone in their database is shopping for a loan or is experiencing another event that could change their loan status. The system gives lenders the information they need, pointing them in the direction of who to reach out to. It will also share insight into this potential new prospect including what loan product they could be looking for based on what’s changed.

The Sales Boomerang system features individual alerts that lenders can turn on or off based on when a potential client or return borrower opportunity arises. These alerts include:

- Mortgage Inquiry Watch

- Credit Improvement Watch

- Equity Watch

- New Listings Watch

- Rate Watch

- Debt Watch

- Life Events

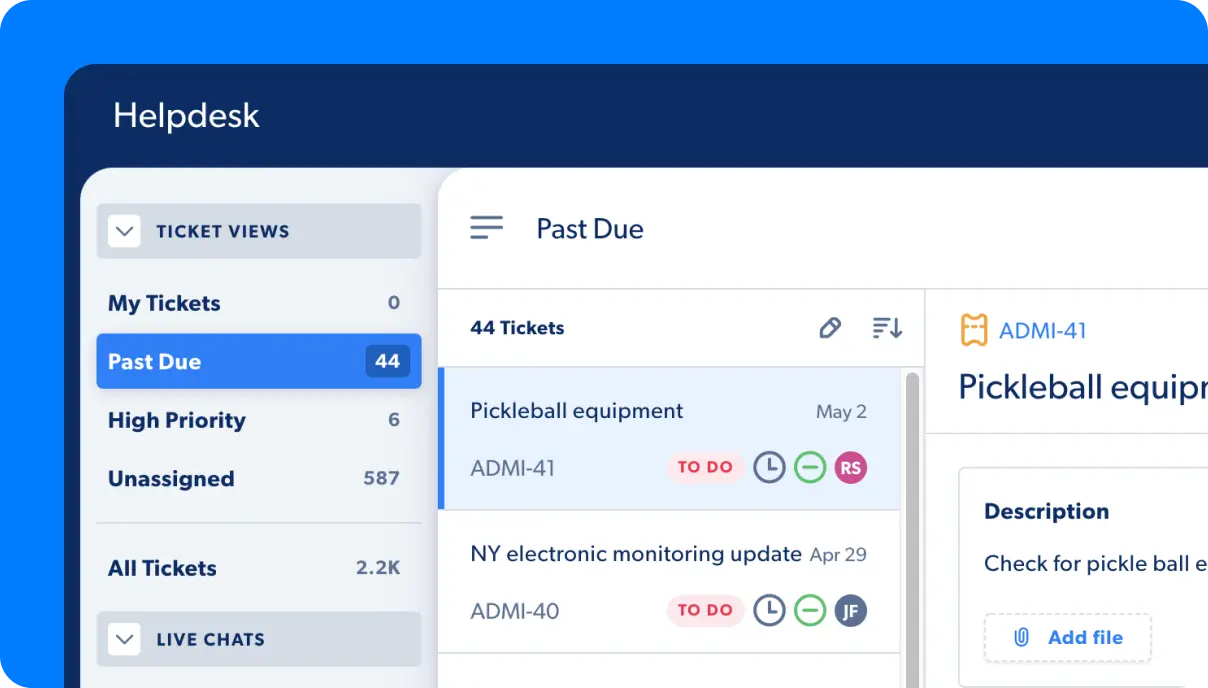

Capacity, a mortgage automation platform powered by artificial intelligence, supports your borrowers, sellers, and support staff with instant knowledge and automated workflows. Capacity enables mortgage companies to anticipate the questions that borrowers typically ask during the loan process, and make their website a hub for helpful information that they’re looking for with our AI-powered software. On average, Capacity correctly and instantly answers 84% of all prospective and current borrower questions without any human intervention. Capacity also helps mortgage companies close more loans, faster, at a lower cost by:

- Using AI to capture and route new leads.

- Providing instant access to Fannie, Freddie, USDA, FHA & VA guidelines.

- Storing and automatically indexing internal guidelines and policies.

- Automating workflows for loan fulfillment and servicing.

- Connecting LOS, apps, and data into a single system of engagement.

Make sure to register for the HousingWire webinar to hear how these companies’ leaders are working towards building a better experience for borrowers with the technology of tomorrow and today.