In this special episode of The Support Automation Show, a podcast by Capacity, Justin Schmidt is joined by John Heck, Sr. Advisor Lending Solutions at Capacity, to talk about the trends and forward-looking aspects of support automation in the housing and mortgage space.

John is a highly motivated professional with passionate leadership and relationship management skills forged by a thirty-plus-year executive track record in growth and business transformation.

Listen now!

Justin Schmidt: John Heck, good morning and welcome to the Support Automation Show.

John Heck: Morning. How are you, Justin?

Justin: I am excellent. Where does this podcast find you?

John: I am in Charlotte, North Carolina.

Justin: Charlotte, North Carolina. Absolutely love the Carolinas. Have not spent time in Charlotte yet but it’s on my list.

This is going to be a special episode of this Support Automation Show. John and I worked together at Capacity, and I’ve known John for a couple of years now. He has worked with us on a lot of the go-to-market strategies with our mortgage offerings and support automation. He has also introduced us to some of our bigger customers and clients. It’s one of our thought leaders and quite frankly, a preeminent thought leader overall in the mortgage tech space.

I wanted to have John on for this special episode to really talk about a lot of the trends and forward-looking aspects of support automation in the housing and mortgage space as we lead up to the big conference season in the mortgage space going into September and October. With that, John, why don’t you give us a little introduction on yourself and how you got to where you are today?

John: Short version is over 30 years in the mortgage space. Started off in sales, transition and operations, transitioned operations into six sigma. Then there was a perfect lead into automating operations probably 15 fifteen years ago, maybe less, transitioned into more of a data-centric focus records management, what’s done with the data that you’re creating, the dark data that all these companies have access to but don’t use properly.

I had a student at IBM who became very in tune with artificial intelligence said that time Watson was being introduced in the financial service industry. I always looked at myself as an entrepreneur, a strategic visionary within an organization. I was exposed to artificial intelligence and really became enamored with how data as a product can revolutionize financial services in general and in more specifically mortgage. I got connected through one of Capacity’s board members to David Karandish, the CEO of Capacity years ago. I’ve been working as a senior advisor for Capacity ever since.

I think the idea of an automated support platform or another way of looking at it would be a federated database. An enterprise data solution, I think, is the answer.

I love working with the culture of Capacity. I love working with the engineers of Capacity because they don’t have any preemptive concepts about how things have been automated in the mortgage space. They look at outcomes that, “Okay. This issue is x. Let’s solve it with y.” That has been very intriguing for me. I love working with the engineers at Capacity. No. I’m not patronizing anybody by saying that. It’s really a great culture.

Justin: It is. Those engineers are extremely talented, one of my favorite parts about the culture here as well. John, every one of these interviews after introductions, I asked the same question. I’m going to ask you the same question I asked everyone else’s, and that is when you hear the phrase support automation, what does that mean to you?

John: To me, succinctly, it’s an enterprise data solution, this of that. It’s the ability to effectively use the data that I own as a customer in correlation with all the other technology initiatives that I have to operate in the mortgage space. Most of which are closed technology environments which present significant limitations.

Justin: Exactly. Related to a closed environment, at least conceptually the computer science unless I’m not accurately quoting here, but I think it’s a good jumping-off point for something we were talking about before we started recording. There’s a lot of data both in and outside of an organization that can be used for decisioning, that can be used for business processes. That data comes in a lot of times, in real-time, sometimes it comes in batches, sometimes it’s the internal systems creating more data, sometimes it’s externalities bringing it in.

Some of that data is well understood. There is an often queried database of that data being sent to applications that are running processes all day. Some of it goes unnoticed, goes unused or there’s computational results of the data that are therefore data themselves. This concept of dark data and how it’s not always recognized and used.

We talked about this a little bit before we started recording. You said specifically that it’s something that you find interesting and see value. I’d love it if you could double click on that for me in terms of what is the type of dark data that you think goes most often underused in the mortgage space and maybe what are some benefits of going down this path of exploration?

John: Again, conceptually, I think that there’s too many intermediaries between where the origin of the data is and actually implementing the data into the manufacturing process. Most of the systems that we’re talking about, the front end of the business, are binary in nature. They’re waiting for things to happen so that the next event can happen. The beauty of artificial intelligence is it replaces some degree of tacit knowledge.

I remember one point, probably four or five years ago, when I’m interviewing a CEO of an event, a non-QM company. He was telling me that you cannot automate non-QM underwriting because of the complexity of it. My response to him was I could create 100 files and give those files to his senior underwriters, and they’d probably be a standard deviation of over 20% of reaction to those files meaning that some would approve it, some would turn it down, some would condition it. Therein lies the challenge for the mortgage industry. The wider the standard deviation of decision making, the more risk for the performance of that asset to the ultimate owner down the line.

Artificial intelligence can be event-driven. When the data is there, it’s almost a series of simultaneous APIs. I use the term bingo logic or bingo decisioning. It’s almost like the least complicated mortgage application is, let’s say, it’s two borrowers, salary, employees. There Are two bingo cards. When the box is on those bingo cards are filled, a decision can be rendered.

By the way, the converse of that would be you’ve got two borrowers that are potentially not married, their partners, and they’re self-employed, and they have multiple investment scenarios. It’s a very complicated file to underwrite. The difference is to just be more bingo cards, more boxes to fill.

Artificial intelligence would know based upon our knowledge base what guidelines and rules that investor needs to look at those data points. If the data meets guidelines, it’s there, it’s good, move on to the next. If it’s inferior or if it’s missing, it can actually send a message to somebody to get something done to fix that particular data. It’s not a linear labor-driven process. It’s an intuitive, tacit AI-driven process where the system of intelligence knows what data has to appear in that particular box, let’s call it, for that particular loan, for that particular investor.

There’s a tremendously inordinate amount of reliance on seasoned people to make those decisions. Most senior people, 20, 25, 30 years of experience underwriting loans is a very costly proposition. It’s very, very cost prohibitive. I always ask people this question. We have the most sophisticated technology in the history of this world. And in the most recent statistics from the MBA last quarter, the cost to produce a loan is the highest in the history of mortgage banking. How do those two things go together? They don’t. It’s an oxymoron. We’re not effectively using enterprise technology in allowing data to drive the events of manufacturing alone.

The other component of this is there’s way too much information and emphasis in automation and configuration on the actual manufacturing process and not nearly enough on the outcome of the manufacturing process. In other words, when the outcome has been achieved, that loan is ready to be decided. That’s where AI and an automated support platform comes into fruition very quickly. It’s ready to go and it’s not an assembly line where really easy loans are being slowed down because of the complicated loans that are in front of them on the assembly line, all of these things should be simultaneous and they–

Justin: Should be parallel.

John: Yes, they should be running simultaneously and parallel and there should be what I call exception processing. If there’s something that somebody needs to interpret, then an individual can and because of machine learning, now that system the next time that that nuance is presented, the machine learning has already reconfigured itself to know that that’s no longer an exception. Again, the focus is having the data drive the process and it’s totally focused on the outcome versus the manufacturing process.

Justin: Right. In maybe a somewhat more layman’s approach and thought process here, if I’m a loan officer and the originator I’m working at has these types of systems in place, they are implementing the technology and processes behind what you just said, what is it that I as a loan officer am going to experience differently versus going to another originator that is still doing things more manually, more in series, having these big complicated loans, clog up simpler ones behind it? What’s the material difference I would see?

John: Well, I think we’re in an age of what I call self-service. I think loan officers should provide two realtors and two consumers to ultimate borrowers. Some type of a module where the consumer can relinquish their data in a secure environment and have it be able to basically frame up an overview of the transition that the borrower is looking for and give them a realistic response like we’ve used the analogy many times with the IRS and TurboTax.

The IRS is extremely complicated. When it comes to whatever you put on a particular line item, it’s very bullying in that it creates other questions. There’s no reason that mortgage companies can’t operate in that fashion. What I see happening over time is that self-service people would prefer to be able to interact with technology on their own to a particular point.

Now when they want to talk with somebody that can provide some expert counseling, they’ve already got a preliminary idea of what they’re looking for, potentially what the pricing may look like, what the variance or the range of the pricing might look like, and they’re in control of the data that they release to that particular module because the consumer owns the data.

Having somebody that is Web3 savvy and internet savvy to rely on somebody to do everything for me, I think that innovation– that trains left the station. I think people want to do a lot for themselves and they want to pull somebody in when they want to pull somebody in, but they don’t necessarily want somebody to drive the process. I think that’s where the sales innovation’s going to happen over time because the cost of sales right now is extremely prohibited. It’s the most expensive part of the $10,000 it costs to produce the loan right now. There’s got to be a better, more efficient way to do that. I think that’s where automated support platforms come in.

Justin: There is a growing feeling that one of these takes– I’m going to run a study to quantify this, but this is a hypothesis of mine. It’s not necessarily a hot take but I think I’m right on this. The expectation of experience that we have in our digital lives, that companies like Apple, Netflix, some of these others are just beautiful– Amazon to a certain degree, they create these really beautiful, seamless, ultra-low friction, exactly what you need when you need it how you need it experiences. The more we live our lives with an iPhone in our pocket and experiencing that UX and setting those expectations, the more we expect that elsewhere in our lives.

It’s the software we use at work, it’s going to the DMV and getting your license renewed, it’s going through refinancing or getting a new mortgage. It is incumbent on anybody who is making an experience in 2022 to make it as seamless and as fast and as convenient as possible because in the world of infinite choice that we live in right now, you’re just not going to win unless you have that dialed for your user and for your consumer.

One of the other trends that I see in the mortgage space, and you and I actually discussed– Well, I didn’t discuss it. I moderated a panel that you were on a month or so ago with the MBA talking about this with John Levick, from canopy, lenders looking for new product lines to offer. Whether that be getting into non-QM or whatever it is. This is a great way for these lenders to diversify through the tumult that we’re all going through in the housing market.

When you look at the most underserved ripest opportunity for originators or services, let’s just say a mortgage business, the most underserved opportunity for diversification, what is it in your mind?

John: Well, I think over the years, has made the sales process to become– It’s a very easy proposition to basically enter information and to get a response back from one of the agencies, one of the Fannie Mae or Freddie Mac.

I think one of the preemptive issues in QM is that there is not one standardized open environment that a lender can operate in with multiple non-QM investors. In other words, with Fannie Mae or Freddie Mac, it’s pretty similar with day one certainty and loan quality platform that Freddie Mac has. They’ve really tried to standardize the way it’s actually originated. In reference to non-QM, there’s a lot of different machinations that lenders have to go through, and so many of them don’t. They just don’t want to offer the products because it’s a different change in venue.

Many times it creates a different manufacturing process. In some cases, there may be even multiple teams that operate with multiple investors. I think an automated support platform, the beauty of it is it can actually standardize the entire QM non-GSE business. There’s a lot of investors coming back now that are offering QM mortgages to compete with the agencies but they’re not offering it necessarily on the agency delivery platforms, as well as the non-QM products. I think an automated support platform provides that.

I want to give deference to the back end of this system. As purchase money decreases significantly, as refinances decrease because rates are going up, mortgages are going to or they are becoming more prevalent automated. Support platforms are a great way to offer those products. Then if you jump to the servicing end of it, which nobody seems to be focused on right now, we all assume that a servicer gets paid usually about 25 basis points for the ability to service our loans. They can actually make money at that as long as all of us pay the mortgage.

As soon as we stop paying the mortgage and people start getting on the phone, when you’re talking about five or six different phone calls with somebody that’s 30 or 60 or 90 days late, you’re talking about five or $600 worth of additional fees that are not covered in the normal servicing process. As this economy becomes more challenging for US homeowners, the bubble is going to switch from to default management, and there’s no better way to keep costs low for a service than to provide a self-service solution. In other words, I can go on, I can talk to a bot. The bot can answer my questions. I can actually upload data to the bot. The environment can look at that data, the automated support platform, a capacity we can use intelligent document processing to extract data to present that data to somebody that makes a credit decision.

There’s a tremendous opportunity in the servicing default management space for automated support platforms because the traditional servicing platforms do not have the capability to operate outside of somebody paying their mortgage. Their general ledger technology platforms and both of the two leading market share providers are mainframe driven environments. They’ve been around for decades with gooey screens.

I thought there’s a tremendous opportunity to be able to lean up the origination process for those that want to survive, because it’ll be a survival of the fittest, for sure based upon profitability. Key-lock focus, I think is a really good place to put some emphasis.

Then the default, if you are in the business of servicing your own assets or owning your assets, somebody servicing for you, having a default management solution now, knowing that the market may go south in the next 7 to 11 or 12 months having one in place I think would be really critical for maintaining profitability.

Justin: That’s exactly right. One of the things that we’re doing here at Capacity that– I obviously am coming from a place of a bit of bias here wearing my Capacity shirt and talking to you.

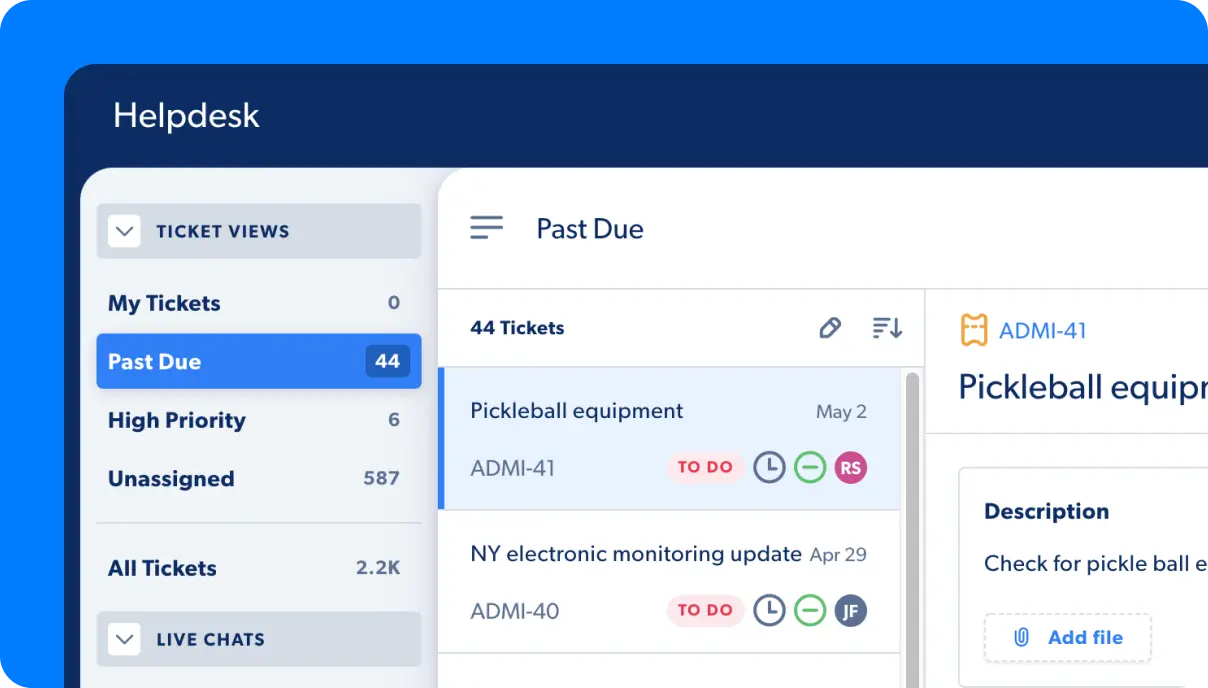

One of the things that we have worked very hard to do, and this is an aspect of our business that I believe puts us in a good position as a market leader is we have built a really good system of intelligence and system of orchestration for lack of a better word, on top of a lot of the existing tech inside a mortgage operation. Whether it’s on the origination or service side and can help facilitate a lot of the data going back and forth, increasing the wheels on decisions, offering self-support, all the stuff that you’ve touched on in the last few minutes, we’re in a really good position to help make that a reality.

Whether you’re at digital mortgage, MBA annual, you’re at a TMC or Lenders One conference, we’re going to be there this year. Stop by to talk to your account executive, give us a call and do whatever we have to do to chat with us about this because we really do have something that can help. These conversations are ones that need to be had because I’m sure the realization of these needs are going on at every lender right now to your point about there’s a potential default management boom coming. I think everyone would agree on that.

You can only have inflation go so high and interest rates go so high and housing prices being what they are like, there’s going to be some issues here and you need to be prepared for the future.

John: To supplement that, I think the real critical issue in the mortgage space that I’ve seen for three-plus decades is that I’m stereotyping, and I apologize in advance for doing this, but in my opinion, the majority of people, they remain tactically focused and they don’t get strategic. Now when business is more difficult to operate is the time to invest in strategic visionary innovation.

Number one, when the market declines, then the only way you’re going to grow your business is redistribution from your competitors. The only way to do that is to be able to operate in a more efficient, more profitable, more customer centric way. You cannot do that without significant automation, it’s just not going to happen.

If you look at the cost to produce alone, we’re talking about anywhere from 9,500 to over $10,000 alone, that rolls down to the closing table. Those costs eliminate a lot of potential borrowers and buyers of homes. That’s why so many people are renting right now. They just can’t afford to buy a house, so we have to lower the costs. The only way to lower the cost is through some type of an enterprise data-driven solution where mortgage companies have to come to realize that their product is data. It’s not the mortgage process. Data is their product, and the output of that data is an asset that they can sell. That’s tantamount to the innovation focus that lenders need to make.

The only way for mid-tier and smaller lenders to compete is to offer a similar scenario that the large lenders have. That’s the ability– they’ve spent millions and millions of dollars on automation. The mid-tier and smaller have to lease it and get the same output results. That’s the way to stay competitive. I think companies like Rocket Mortgage, they’re a marketing company that happens to do mortgages. They spend a lot of money marketing their solution for sure.

Justin: Exactly, they do. While I’m always a fan of good marketing, there is a certain beauty to actual value and stuff that works, which is what the industry is going to need, and what you and I both believe Capacity provides.

I want to close our conversation with a bit of a forward-looking segment here, and I’m really curious about your thoughts on the intermediate, and maybe let’s think about the next few years and maybe next 10 plus where the tech and mortgage worlds are going to continue to evolve and what the future mortgage tech looks like. I know you are a very active learner and advocate of some of what Web3 is in the blockchain and some of the deft stuff that’s happening. I’d love to get your take on how you see that adding value to the mortgage space and then maybe a prediction for the future. Looking out a little further ahead.

John: That’s pretty easy, actually. I think that the traditional mortgage industry focuses on automating the front end of the business. I think we’re at a point now– In the 1980s, technology was a massive change in innovator for the mortgage industry. It changed and drips and drafts because personal computers changed a lot of the ways that people did business from desktop computers.

I think now cryptocurrencies in general, people look at them, especially with all the recent media about the decline of these crypto platforms and the concern about fraud and some of the other things that are happening. I think capital markets in general structured finance is going to be the change agent that actually revolutionizes the front end of this business because more and more institutional investors are getting into the non-GSE QM space and the non-QM space.

They’re looking at it from a profitability standpoint. When you tokenize an asset and you trade it and you have the ability to put it in a repository in the back end, you’re eliminating all kinds of costs, fraud, speed, you’re producing speed. You have a better digital ledger of what’s happened. You have a complete historical event of that asset. You can look at performance analytics down the road. The structured finance part of this industry is going to be the innovation that affects rapid change over the next couple of years, and it’ll never look back.

If you don’t transition into tokenization of assets and trading assets on digital platforms, you’re just not going to survive because the economics won’t– they won’t work.

Now, what’s been lacking in cryptocurrency, which is desperately needed in the mortgage space, and in the structured finance space is regulatory governance. The cryptocurrency, they talk about it being self-governed, never going to work in financial services when you’re talking about structured finance. There has to be governance and regulatory compliance issues that manage how things are transactive.

As those two meet, technology and the regulatory issues, then you’ll see massive innovation happening and you’ll see cost reductions and how loans are being delivered. The beauty of the non-agency loans is you’re going to see things like assurances that basically cover anybody’s losses if loans go through a particular manufacturing process. The capital markets over the next 18 to 24 months are going to really create a significant change. Over the next eight to nine years thereafter, business will never be the way it’s being done today. It’ll change drastically.

Justin: Love it. John, it is always a treat and educational journey for me talking to you about this stuff. I really appreciate you taking time out of your day to join us on this special episode, The Support Automation Show. I’m going to end this conversation the same way I end them all, which is a few quick-fire questions for you. First thing that comes to your mind, what’s the book that you most often recommend to people?

John: The Big Switch from Edison to Google, I think Nicholas Carr who wrote it. It’s an older book, but I love the following: the evolution of change and how people were risk-averse and those that weren’t affected by massive innovation. I love that book. It’s one of my favorite books.

Justin: That’s a good one. It hasn’t been recommended on this show before. I’ll always appreciate it when I get a new one. Second one, what is your best tip, practice, trick, piece of software, whatever it is that you use to manage your productivity throughout the day?

John: Well, I’m going to change the question a little bit and-

Justin: Go for it.

John: -I’m going to relegate it more toward the industry. If I’m in the mortgage industry, whether I’m a servicer or provider, or lender, I’m going to look at technology and figure out how it can become my infrastructure, my enterprise, where I own the data, it’s in my data environment, and this enterprise technology that I’m using allows me to communicate with anything else that’s out there, and whatever it’s costing me, I’m getting a direct proportional gain in ROI.

In other words, if I’m spending a dollar on technology, I’m getting $3 worth of ROI output. That has to be tied to any decision that a company makes when it comes to a technology provider. It has to bring value, measurable value.

Justin: Love it. Well, John, we are at time. I know you’ve got to run to another appointment, but thank you for coming on here and giving us your insights into the mortgage tech space and the future of the industry. As I said, at the top, we’re going to be at all the big shows this fall. Everything from MBA, annual, to digital mortgage, to TMC, Lenders One, we’ll be at all these places and someone from our team will be there. I am really excited for the prospects of our team meeting some great people at those shows.

John, thank you so much for your time and you have a wonderful day.

John: Appreciate it. Thank you.