Digital technologies such as artificial intelligence (AI) and machine learning (ML) have the potential to transform the mortgage industry. But are lenders taking full advantage of these opportunities? According to Forbes Insights and Freddie Mac, approximately 50 percent of lenders have achieved some level of digital transformation, but it’s mainly on the customer-facing side. On the back end of the business, most lenders are still using time-consuming manual processes to complete loans. This feeds into the customer-facing side of the business as mortgage companies fail to meet customer expectations for speed and easy-to-process loans.

A digital transformation of those manual processes will create true operational efficiency and revenue growth for mortgage companies that embrace it.

This article will cover why digital transformation is important for a mortgage company—on both sides of the business. We’ll also discuss why only 40 percent of large and small mortgage companies currently have the right mix of digital tools to capitalize on these new technologies.

How are digital technologies replacing outdated processes?

As mentioned, lenders can deploy digital technologies on the front and back end of a mortgage company. Here’s how these companies can put the technologies to use in each case.

On the front end to provide a better customer experience.

Lenders use AI-powered support automation platforms like Capacity as the 24/7 face of their customer service with integrated chatbot functionality. Mortgage companies can assign a branded name and personality to a chatbot and empower it to take over most of the repetitive tasks a customer service agent would typically handle.

These include:

- Answering repetitive questions about rates, loan types, and other general information

- Directing potential borrowers to the correct application forms

- Helping customers calculate their income

- Referring more complex questions to the right person

- Updating customers on their application’s status

- Reaching out to and following up with potential homebuyers

- Sending out customer satisfaction surveys

A chatbot can complete these tasks near-instantly, giving customers a fast, personalized experience while saving companies time and money. It also allows their employees to focus on tasks that generate more revenue, such as sales and marketing.

AI-powered support automation platforms like Capacity can also collect data and analyze it at the click of a button, providing valuable customer insights.

On the back end to help lenders process loans more efficiently.

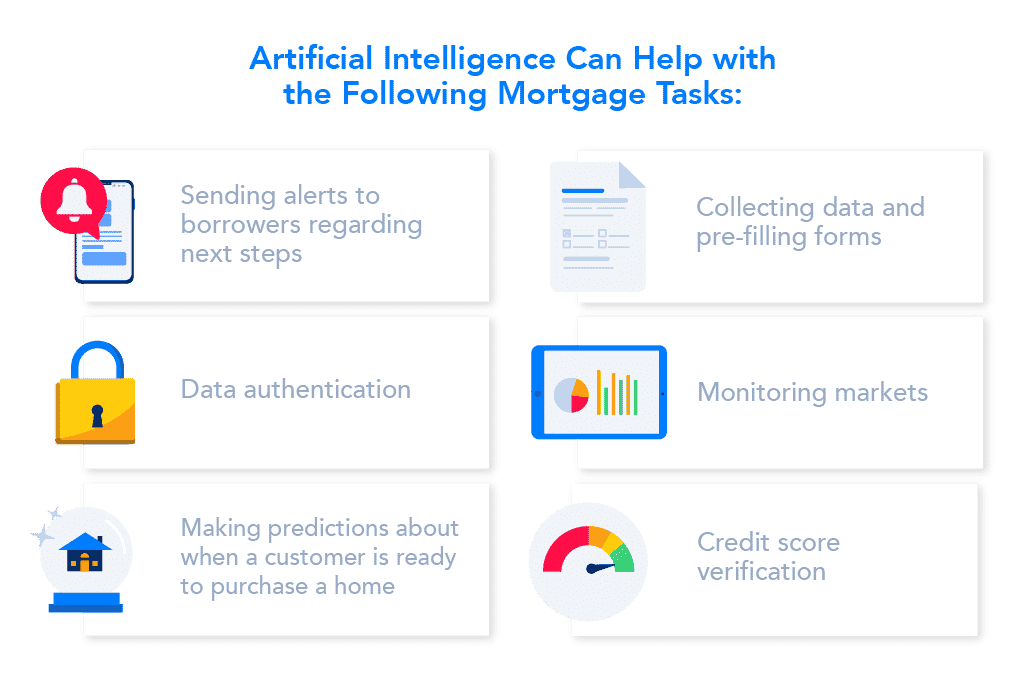

In the past, every step of the underwriting process was manual and involved a pile of paper documents. Now, AI-powered support automation platforms like Capacity can handle most of this work, freeing lenders to perform tasks that generate more revenue.

Manual reviews from a loan officer have transformed into algorithms that can scan thousands of documents in seconds to determine whether a loan applicant meets a lender’s qualifications.

Instead of manually tracking loan steps, robotic processing automation (RPA) can monitor every move made on a journey to close a loan. Lenders can upload their entire process into an automated workflow to ensure they complete every step at the right time. If something goes wrong, managers can find the problem instantly.

With technologies like Intelligent Document Processing, lenders can upload documents at the click of a button and instantly turn them into secure, searchable electronic files.

Loan officers and brokers can connect to customer files, organizational knowledge bases, and systems like Fannie Mae through a conversational chatbot that works in channels they already use, like Slack. They can even give it directions, such as, “Show me the loan for the Johnson family.”

As well as helping streamline processes, AI-powered support automation platforms can quickly identify data trends that help lenders improve profitability.

Why aren’t more mortgage companies fully embracing digital transformation?

Many mortgage companies haven’t fully embraced these digital initiatives yet because they fear disrupting their business operations. They might also worry about the potential cost of these new business models or feel constrained by legacy technology.

However, lenders that aren’t capitalizing on these technological advances miss out on cost savings and rapid scaling.

It’s clear that mortgage companies that want to remain competitive need to exploit digital technology to drive down costs and streamline processes. Digital transformation is the key to success in a changing market.

How to implement key digital transformation trends.

Mortgage companies that wish to be successful moving into the future should apply digital transformation in their customer-facing and back-office operations.

These are the three key areas where mortgage companies should focus their efforts:

- Bringing down costs and streamlining processes through automation. By automating these processes, mortgage companies can focus on higher-level projects and boost the efficiency of their back-end operations.

- Investing in the customer experience with chatbot functionality. A chatbot can complete customer-facing tasks that might otherwise be left unattended, like following up with potential customers or sending surveys.

- Exploiting data insights to generate new revenue streams. AI-powered tools collect data and analyze it at the click of a button, providing valuable insights for mortgage companies looking to exceed customer expectations and meet their business goals.

How can Capacity help?

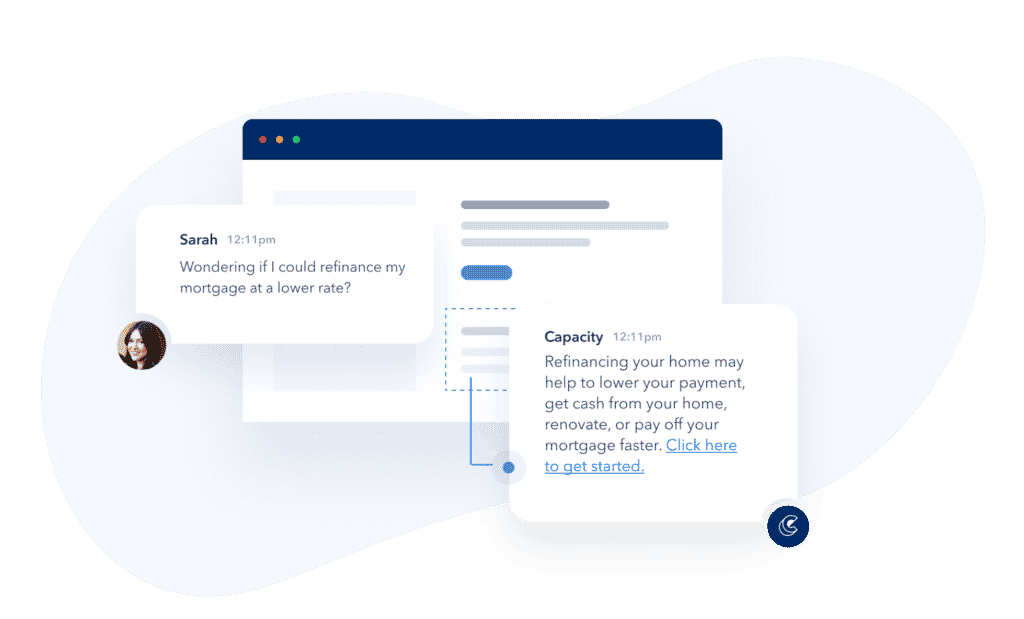

Capacity is an AI-powered mortgage support automation platform that helps lenders meet customer demands and improve business outcomes.

Loan officers and brokers can use it to instantly tap into key systems like Ellie Mae, Encompass, and AllRegs on their desktop or mobile devices. Borrowers will benefit from seamless 24/7 customer support.