There isn’t any question that AI and automation can streamline mortgage origination, underwriting, and loan servicing. Although, collecting data can be time-consuming, many mortgage lenders still rely on optical character recognition (OCR) and manual processes to pull data from documents in physical or digital form.

OCR was originally employed to save both time and money so that mortgage employees don’t have to manually read every document from their mounds of paperwork. The issue with OCR is it is designed to look for data at the same location on every file, meaning it works best only with structured data and does not have the ability to use keyword searches or even read information from a document with low image quality. Further, OCR can only capture a section of data so human workers still have to validate the data.

On the other hand, AI can extract more information, classify more documents, and recognize patterns on structured and unstructured documents via intelligent capture. Automation can route the data to the right recipients. As a result, AI and automation are scalable where OCR is not. The fact is in a highly competitive market, mortgage lenders need to reposition employees to tasks that require more expertise, hence why we’ve included this buyer’s guide to AI in mortgage.

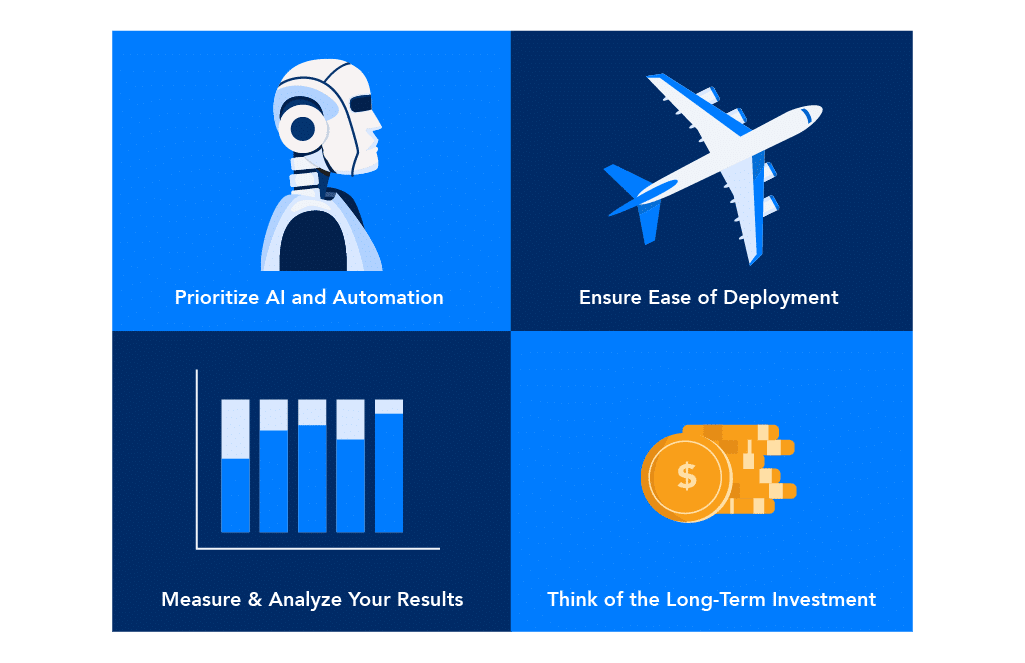

There are a multitude of choices when it comes to AI and automation solutions. Deciding on what works best requires a plan. Here are a few tips:

- Prioritize AI and automation – When loan officers are busy with origination, or underwriters are busy chasing down borrower documentation, intelligent automation can give mortgage lenders the ability to automate tasks that free up more time for human employees to focus on customer needs.

- Ensure ease of deployment – Lenders seek out tools that are easy to implement and frictionless to use. Technology should make processes more convenient, not more difficult.

- Measure and analyze your results – The most vital measure is whether the platform offers a marked ROI within three months. What does the reporting dashboard look like? How is success measured?

- Think of the long-term investment – Does the platform set your business up for the future of work? Will your employees spend less time with their hands and more time communicating with your customers?