Artificial intelligence (AI) chatbots are no longer a dream, but a reality. In the mortgage industry, lenders are realizing the benefits of implementing chatbots. More and more mortgage companies are experiencing the benefits of using conversational bots to handle borrower inquiries, streamline their business processes, and even generate leads.

What was once limited to rule-based and simple questions has evolved into efficient self-service bots that understand user intent and can hold intelligent conversations. In fact, some chatbots can even handle thousands of borrower requests every day. As borrowers and consumers get used to instant support, they will only continue to grow in popularity in the mortgage space.

What is an AI chatbot?

A chatbot is a piece of software that can hold an instantaneous conversation with a human via regular text or multimedia messages. Through machine learning (ML), chatbots can understand user input by recognizing patterns and context. They then suggest relevant answers and solutions.

Chatbots have been around for a while in the form of games and other entertainment-focused applications, but now they are being applied to business processes and assist humans in specific tasks such as applying for loans or answering technical questions. Chatbots are a powerful tool in the hands of mortgage companies because they boost user engagement, improve customer service, and increase employee productivity.

How a chatbot improves the lending process.

When a borrower is applying for a loan, they have to go through several processes before being approved. To make matters worse, borrowers are not always qualified at the end of the process even after spending all that time.

Therefore, it’s not surprising that borrowers don’t want to be bothered inputting information for a loan that they might not be qualified for when it takes several hours to complete. Chatbots simplify the process by asking for information in natural language instead of depending on the borrower to fill out complicated forms.

Machine learning can even help determine if the borrower is qualified before the app gets to a loan officer, therefore saving time and effort for the borrower and the lender.

A chatbot also provides easy access to information for clients and lenders around the clock. It can even automatically reach out to borrowers or follow up. In the mortgage industry, this is a great way to improve support for borrowers. Chatbots free up employees from answering basic inquiries that don’t require human intervention and allow them to spend their time helping borrowers who need more complicated support.

By using a chatbot to simplify the application process, the mortgage industry can reduce time and effort for both borrowers and lenders while saving money in the process. It’s not surprising that many mortgage companies are looking for information on how to create AI chatbot technology.

How to build an AI chatbot.

To start building a conversational chatbot, lenders must have a good understanding of the lending process and a clear picture of their customer journey. They can then customize the bot to fit the needs of their company.

Once a company has mapped the main ways people will interact with its bot, it needs to tailor the responses given to maintain a positive relationship with the user. Lenders can do this by using natural language processing (NLP) to understand the context and, through deep learning, find what is relevant to their users based on their previous interactions with the bot or other human responses they’ve received.

Finally, an AI chatbot can be trained using the data lenders already have from their existing customer service team. They should start by manually recording conversations between borrowers and lenders. Then they can train the chatbot to understand what is being discussed and have the necessary answers to help lenders get what they want.

However, building a chatbot that can replace a human agent in most scenarios takes a lot of technical work. Using a platform already equipped with chatbot functionality saves mortgage companies time and effort.

Why it’s easier to work with someone with the right tech experience.

Building tech from the ground up is complex and time-consuming. It’s often easier to outsource features like this to experienced chatbot developers with the knowledge and experience to build, deploy, and maintain software that supports a business.

For mortgage companies without the resources to build out an AI chatbot from scratch, AI-powered support like Capacity is a great option.

What is Capacity?

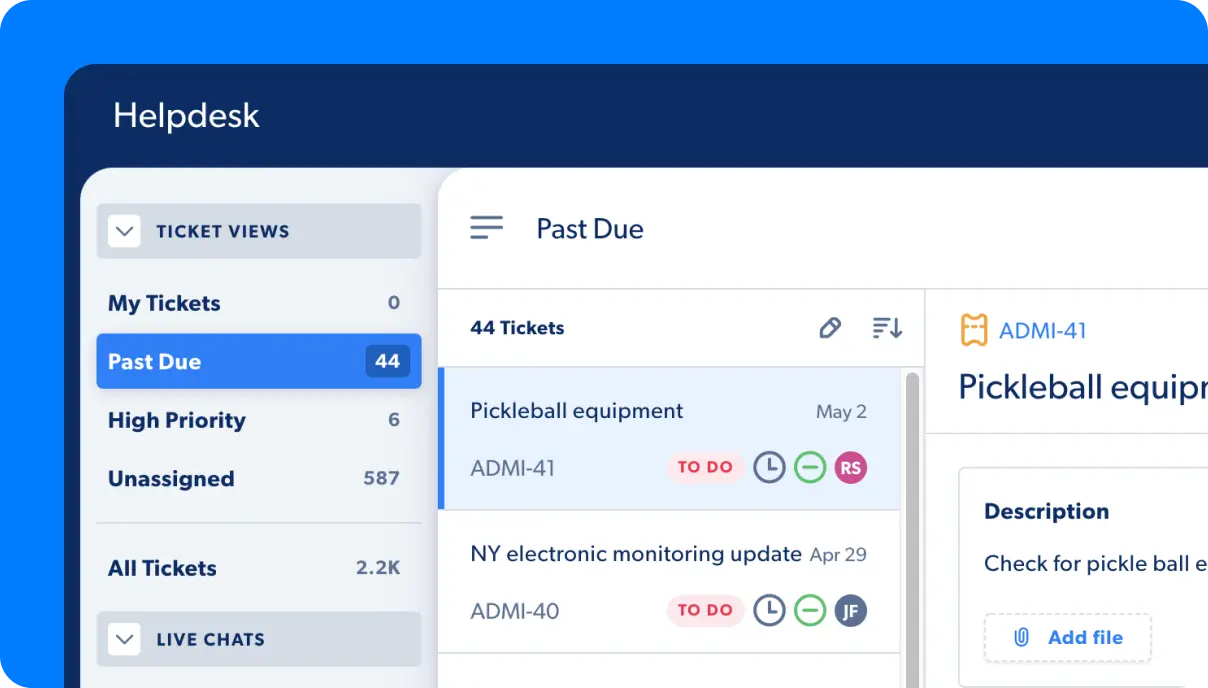

Capacity is an AI-powered platform that helps mortgage companies get an edge over the competition with features like automated support and chatbot functionality.

Mortgage professionals use Capacity to be more productive, lead the industry, and manage the business more efficiently. Capacity works with a range of mortgage lenders. Not only is our platform cost-effective to implement, but lenders can even go live with Capacity within 30 days.