Scott Roller, Co-Founder of Vendor Surf and Founder of 3W Partners, joins us in the next episode of The Support Automation Show. He discusses the role support automation plays in the mortgage and credit union ecosystems and why with the end of the ReFi Boom, there’s been a major shift in focus to digital transformation efforts.

Listen now!

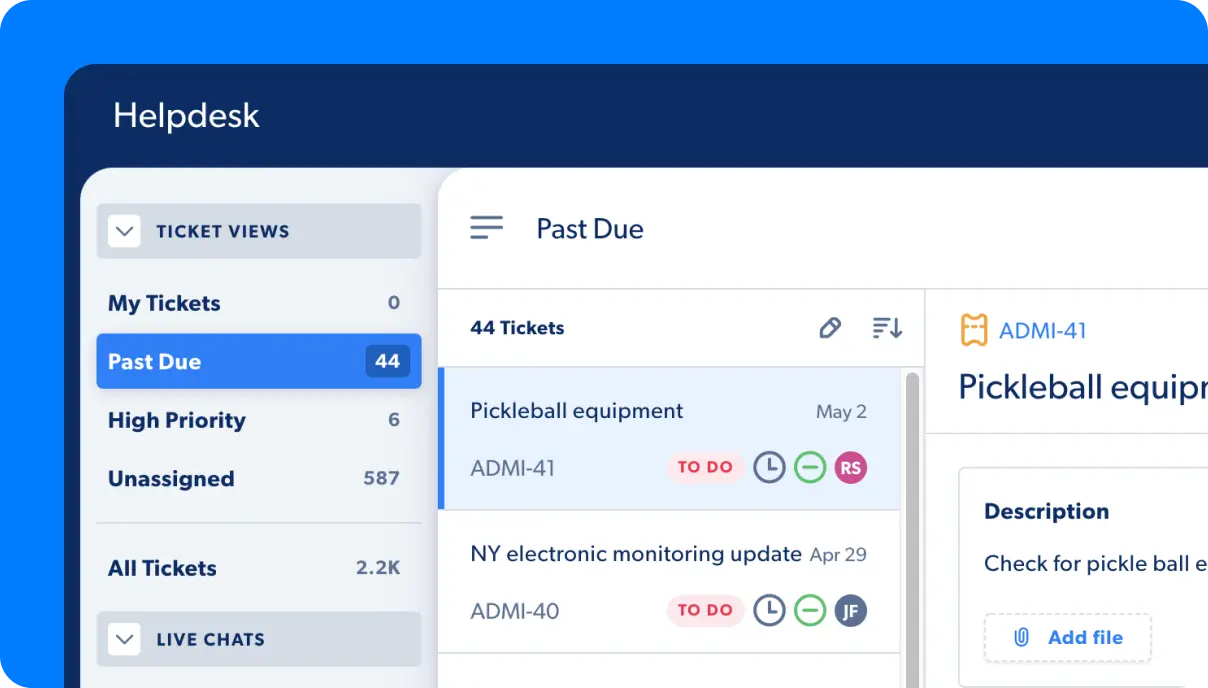

Justin Schmidt: Welcome to The Support Automation Show, a podcast by Capacity. Join us for conversations with leaders and customer or employee support who are using technology to answer questions, automate processes, and build innovative solutions to any business challenge. I’m your host, Justin Schmidt. Good morning, Scott Roller. Welcome to The Support Automation Show.

Scott Roller: Thank you, Justin. A pleasure to be here.

Justin: Where does this podcast find you?

Scott: I am in beautiful St. Louis County, Missouri, not far from where you guys are at.

Justin: No, you’re not. I’m a city dweller myself, but we’re all St. Louisans at heart. Scott, to get us started, why don’t you tell us a little bit about yourself, how you got into the mortgage space and then maybe what Vendor Surf in 3W Partners does?

Scott: I spent 25 years in corporate America, Justin. The first half of my career was in telecommunications around the likes of AT&T, Loosen Technologies. Then the latter half was in financial services, a MasterCard affiliate in the payments processing side with one of the top four mortgage lenders in the country for about eight years. After that eight year-sentence, when you’re the fourth largest checkbook in the industry from a vendor perspective, you get name recognition, people know who you are.

I always wanted to get back to my original roots when I was– starting at age 12, I had my own businesses and after 25 years of corporate America, I full-circled back to that. I started a boutique consulting firm 10 years ago, believe it or not, called 3W Partners, an all things vendor. If you’re on the lender side of the house or you’re on the vendor side of the house, and you need to understand how to bridge those gaps, that’s what we do. We’ve supported the biggest lenders and vendors on the planet, you name it. If it’s vendor related, we’ve got the passion and the expertise. We’ve supported a lot of different clients, and we still do today, and really enjoy that.

Four years ago, we launched Vendor Surf, which is still, four years later, the industry’s only tech-driven search engine. Think of it like an Angie’s List where your consumer is looking for deck builders and roofers and citing people. That’s consumer driven, but Vendor Surf is purely B2B for mortgage and credit union companies that are looking for vendor partners.

You can go to vendorsurf.com. You can search through roughly 70 different categories and say, “I’m looking for an appraisal vendor. Here’s 14 appraisal vendors,” and then you select from unique search filters. As you select your search filters, your list of options shrink in direct correlation to your purchasing needs.

It does online due diligence in real-time as you select your filters and there’s nothing else out there like it. It’s been very popular, and we just celebrated our four-year anniversary this past December.

Justin: Well, congratulations on that. It is nice that the mortgage and credit union space has their own G2 or Capterra or something that has the vendors in that industry all cataloged, easy to find, and easy to navigate. It’s a great site.

Scott, I’m excited to talk to you because we at Capacity have a number of customers who are in the lending space and these conversations are always fun for me because it’s a nice little slice of the broader support automation puzzle that we can share with our lender and mortgage customers and other people in the space because mortgage has a concept, the mortgage industry, getting a loan, servicing a loan, what happens if you default on the loan, what happens if you have to refinance a loan, all the different hands that touch a loan from when a home buyer sits down and fills out an application through when they pay their bill every month.

There’s a lot of room for automation. There’s a lot of processes and manual work that needs to be automated. There’s a lot of documents that need to be scanned and processed in an automated fashion. It’s just a perfect use case for support automation. That preamble is for the question I want to ask you, which is the first question I ask everybody on this show. That is, when you hear the word “support automation”, what does that mean to you?

Scott: Support automation, to me, is plug-and-play building blocks that won’t take an army of loan personnel to deploy, and it can come in and give you some quick hits and productivity, effectiveness, quality, and budget.

Justin: There is definitely a lot of impetus in support automation to get issues resolved, questions answered quickly. It’s a huge part of the discipline. It’s a huge part of the value product that we here at Capacity try to ensure is delivered. Every other vendor and technology provider in this space is trying to do the same thing. What’s interesting to me is where support automation comes in and how it can be leveraged is different depending on what the macroeconomic conditions of the particular use case are.

In mortgage specifically, now is a very interesting time. The rates are continuing to go up, the refinancing boom of the last year-and-a-half or so is largely over. You mentioned exactly that in our correspondence before this interview with the refi boom ending, a major shift needs to happen to focus on digital transformation. I would love it if you could unpack that a little bit, and we could use that as a jumping-off point for some additional conversations because I think this is a really salient point.

Scott: Sure. I want to backtrack a little bit.

Justin: Yes, go for it.

Scott: To set up, getting to the refi boom and the flip to the purchase market, one of my roles, one of the things I always aspired to be when I started my consulting firm, 3W Partners, a decade ago was I wanted to be seen as the analyst, the company, the individual that followed this space relentlessly, knew who was on the way up, who was on the way down, who was going sideways and why, who to run to, who to run from, and help people make wise decisions on who to partner with because there was really a lack of that, of someone that was expert. They dedicated their existence to the vendor market.

I followed you guys when you were Jane.ai. That’s how far back I remember you guys. I was impressed, but I was uninformed. Being local to you guys, we’re 20 minutes from each other, I had the chance to come down and say, “Hey, this is what I do. I’d love to learn more.” I knew that you guys were going to make a big splash in the industry. I stay in touch with you guys lightly, but I consume as much as I can.

I see Josh Katz and other team members out there attending so many events, your marketing team producing so much great content, that I think what I have seen is you guys have defied what has happened in the past few years in this refi boom. The feeding frenzy has officially ended. People have had to push their chairs away from the buffet table. It’s no longer a game of just, “Everybody, all hands on deck, grab the janitor, ask him or her to put them mop down and get out here and process some loans because our pipelines are filling up.”

Those days are over. People have to be proactive now, and they’ve got to do things to help their top line and their bottom line. It’s a very different market. We’ve seen a lot of consolidation on the lender side and surprisingly, even more on the vendor side. I published an article a few months ago about all the M&A in the past two years. It’s mind boggling just about one a week, a major M&A event. You can see there’s a lot of transition and a lot of turmoil. How you plan for that is going to determine your ultimate fate.

With you guys, I said you appeared to have defied the industry norms. What I have heard relentlessly for the past couple of years when we’ve had historic low mortgage rates and historically high pipelines, everybody refinancing, and sometimes multiple times, that if you’re a vendor out there selling your wares, it’s been a tough road. Most vendors have got their hands in the face, “Not a good time for me, Justin. Come back and see me in a year.” It’s all hands-on processing loans. It takes time, effort, focus, deployment resources, and we just don’t have that right now.

One of the big things I always had trouble with when I was at the big lender was getting IT resources. They would come to me and say, “Hey, if it’s not legal regulatory compliance, come see me in two years.” It’s tough to get vendor deployment. In the past two years, I see a lot of that having gone on with the refi boom, “Hey, if it distracts us from our own printing press of money, now is not a good time.”

You guys have produced some incredible growth during a time when very few people have got anything other than a hand in the face. I think that’s been key. I’ve seen so many people, I’ve talked to so many clients and prospective clients, about, “What do I do? How do I get my reach out there? How do I get my message? How do I get people to absorb my value process?” It’s been very tough.

Right now, people are finally starting to see proactive reach-out from lenders, credit unions, et cetera, to say, “I need this kind of help.” Not everybody’s desperate but there’s a varying degree of urgency on everybody’s part. You guys, I think, are positioned very well with the products and services that you bring to the table.

Justin: Thank you. I would like to think so as well. You bring up an interesting point here. This is one of the undercurrents of support automation. That is, in moments where all hands are on deck, in moments where you have people operating at maximum capacity, pun intended, you end up in this situation where there are absolutely processes that are repetitive, you have work that is mind-numbing, you have your best people bound, if you will, by this repetition and by this mind-numbing work, and you’re going too fast to stop and think about how to address that, but maybe it’s not the kind of environment where you’re going to hire more to alleviate that concern.

You end up in a situation where a lot of that mind-numbing, meaningless, and mindless work ends up falling onto the desks of some of the more important people in the company. In some instances, this is your customer support agents that are dealing with customers. It could be your IT help desk dealing with your employees, or in the mortgage space, it can be the underwriting desk, the scenario desk, the sales support, if I’m trying to translate this for a general audience, that lenders and originators rely on, to get accurate information, quotes, understand the guidelines properly, and do all the things they need to do to help facilitate a loan.

In your view and where you see across the market in the mortgage and credit union space, where do you see automation making the most progress? Do you see it in tools for the borrowers? or do you see it more for the tools for the lenders at the institutions?

Scott: It’s a great question. I think the answer is very pivotal based upon where the institutions have invested already. There’s a lot of money finally. There’s a lot of Silicon Valley and investor money hitting this industry. We’ve complained for 20 years that we lack behind health care and other industries, and there’s finally been some good leaps forward.

A lot of those leaps forward have been on the front end, the point of sale, borrower engagement, borrower interaction, where today, if you don’t have online tools to capture and nurture your borrowers or your prospective borrowers, it’s game over, you are going to lose that. It is a rite of passage.

For the people that have already invested there, I think it goes more toward the steps in working the loan file that are still causing us to be 45 to 65 days in the processing time. Having worked directly at a lender, there’s always this clash between sales and operations. When things go awry, the operations teams blame the sales teams for bringing crap, “The stuff you’re throwing over the wall is terrible. You’re not even doing everything you need for it to qualify as a full application.” The blame goes on from the sales guys to the operations, so there’s this battle instead of a solution.

It really, I think, Justin, depends on where has the investment been made in the past? and where are your pain points now? I see a lot of investment trying to break down the very arduous underwriting role. Now, in times past, I would say prior to 10 to 12 years ago, underwriting was never to be but touched a very sacred environment. The underwriters have their signature and nobody can invade their realm and do anything on their behalf because it’s just not allowed, it’s too sacred.

I started to see some of those walls break down probably about 10 to 12 years ago, where lenders would even go offshore to other countries and have underwriting help, taking some of the menial tasks off of underwriters so that underwriters could really get to the point of making the decisions on whether or not to underwrite the loan, and taking a lot of the mundane, looking for fraud, and all these; is there are different type font? has somebody glued or taped some number, an extra zero on that pay stub? It’s a different font or something like that. I started to see that get broken down and that was a real leap forward in my mind.

Now, in other cases, servicing has always been really archaic. There’s so much opportunity, and I think it really depends on the natural life cycle of where each of the institutions have spent already, in addition to what are their real Achilles’ Heels right now? From the chair that I sit in, I’ve got a very good vantage point that I see it all. I think we’re solutions like what you guys have, they can be plugged in, really in any of the big three: origination servicing, default servicing, opportunity, and balance.

Justin: There is absolutely a rising need across the value chain. For our listeners who aren’t in the mortgage industry, can you briefly define what servicing is? When someone in the mortgage business says “servicing,” what does that mean?

Scott: Sure. Think of it as an account service, no matter what industry you’re in.

Justin: Thank you. That’s the path I was leading you down is to generalize that. Please do so because I think there are some great lessons to be learned for any support leader in this. Go ahead.

Scott: There really are. I don’t care what industry you’re in. If you’re in the utilities industry, if you’re in retail, if you’re in credit card, you bring on a customer, you bring on a consumer. You’ve got an established relationship with them and it’s typically an ongoing relationship. It’s not once and done. In the utility industry, I move, I sign up for electricity with the electric company here in the St. Louis area, Ameren Missouri. They have to service my account on an ongoing basis. I use electricity, I may have outages that I need to report. I may have all kinds of things that come up, so they have to service my account as long as I’m a client.

In the mortgage industry, it’s no different. The mortgage industry has three major pillars. The upfront origination process is, you bring borrowers to the table, they fill out applications. It’s sales. You fill out applications, you process them, and you get them to the closing table. That loan closes. It literally leaves the loan origination process and goes into the servicing department.

The servicing department is going to collect payments and handle all customer correspondence and calculate all of the escrow and mortgage and tax and insurance, and it’ll be the liaison in the mortgage servicing department to all the borrowers in their portfolio. It’ll stay that way as long as the people are paying. Once you get to be slow pay or no pay in mortgage, you go into a third pillar, a not-so-good one, and that would be the default servicing department. That’s for people that are struggling to keep current. You handle things like loss mitigation, mortgage modifications, what are the things that are disposal to keep people in their home?

Support automation, there is opportunity in all three of those pillars, and those things overlay. That utility company has the upfront sales, the servicing, and the struggling payers as well, so not too different, I don’t think, in many industries.

Justin: It’s not. The piece of this that I think is important for people to internalize and think about under the auspices of their own business, mortgages are very emotional purchases. Oftentimes, for us as individuals the biggest check we write is the down payment to our house. The sword of Damocles that hangs over all of our heads is our mortgage payment. When I think about my bills, the single largest bill I have is my mortgage payment, and I’m not uncommon in that regard.

I say this to say that the servicing of that loan is a big deal to the borrower when they have to call in because there’s some sort of an issue. If they know they’re going to be late for a payment, the fear there isn’t, “Oh, I’m going to get my Netflix account shut off for a month.” You catastrophize into, “I may lose my home.” What is just another Tuesday on the job for someone in the servicing department at a lender taking phone calls or ensuring collections bills or whatever, it could be a very emotionally fraught time for the person calling. Therefore, as much as you can to, very quickly, accurately, and low-touch, resolve issues for borrowers in servicing, the better.

Extrapolate this into something like, I don’t know, I’m going to pick this out of a hat, retail and you have people who need to make returns, or for a SAS business, you have customers whose account got locked out or a feature isn’t working as it should or whatever it is. While the consequences of being able to return an item or getting an account password reset might not be as dire as losing your home, I think the mindset of mortgage servicing and how to automate and optimize that process is applicable for those outside of the business.

That’s just a call-out I want to make because we talk to a lot of people on the show that aren’t in the mortgage space, we talk to some that are. I think just for my own edification, understanding what we can learn from the mortgage space and apply to the larger economy, for lack of a better word, is valuable.

Scott, I want to pivot and get into something that I think you’re uniquely positioned to discuss given Vendor Surf and some of your consulting roles over the years, and that is implementing technology inside of an organization. If you were to start fresh with someone, you probably have done this a bunch of times in your career, who’s looking to bring automation into their business, what are some of the first things you have them do to prepare to make the right decisions in that journey?

Scott: Well, that’s really interesting. I think first and foremost you have to understand, to an extreme degree, the challenge or the problem you’re trying to solve. From a lot of the consulting assignments that I’ve taken on where tech has been involved, they’re very generic, “We need a POS solution. We need better borrower engagement.” When you really start to say, “Why?” by not having it, what are the problems that are being caused? It’s really understanding, to a great degree, what is it that you’re trying to solve and what are the proposed outcomes? Definition, in the beginning.

I think it’s super-incumbent to talk very, very specifically with your service providers that you’re looking at, Capacity, for example, not only help me to understand the solutions that you have, but give me some real-life use cases where you’ve come in and you’ve solved this for somebody. Now, because of confidentiality agreements, you’re not always able to talk about, “Oh, we did this for Wells Fargo,” or, “We did this for US Bank,” but you can say, generically, “We’ve done a few of those for around three top-10 lenders or two of the biggest brokers on the planet.”

You can help give scale and a definition around that. You really need to find out, not only about their capabilities but their experience in solving these issues, “What’s their track record? I don’t want to be the guinea pig here.” Then you have to say, “Hey, Capacity, hey potential vendor, tell me about the heavy lift on my end. Let’s talk about the deployment process.”

As a lender, I’m not going to be able to bring a lot of resources to the table. Before we make any decisions, help me to understand the deployment lifecycle, what are the stages? and give me some idea, in specific terms, about resources from my side and then resources from your side and specific tasks. What are we going to be asked to do? How many people is it going to take? Because that is potentially going to be an issue.

As I mentioned earlier, with the refi boom having just ended, priorities have greatly shifted. As priorities shift, resources shift. This has to be a priority that is in line with, not only what we can afford from a budget perspective but what we can afford from a resource perspective. Resources are getting thin. You’re starting to see some constricting, some downsizing at lenders, so it’s a very, very fine line. Obviously, API integrations are all the rage as they should be, but you really need to understand, not only budget requirements but resource issues. Too many people fail to understand that.

Justin: Yes, they do. There’s a danger in shopping for technology, and this is applicable regardless of your function. HR, IT, marketing, sales, support, development, you pick it, this holds water. You really need to understand the business processes, the people involved, the stakeholders involved before you go looking for a magic bullet that you can just fix all your problems with or duct-tape some sort of solution on top of a mess of a business process and hope everything is going to work out. There’s a fundamental layer of understanding downstream effects and upstream inputs on what you’re doing and what you’re shopping for.

Scott: So true.

Justin: It’s very easy to get wowed by great marketing, impressed by a demo, newsflash, all software looks good in the demo, [chuckles] and then you wake up six months later and you’re like, “Oh no, this is not what I intended.” For something like automation, this is especially important because you’re having customers or employees, in any case those are very valuable stakeholders, interacting with the outputs of that automation. When automation goes wrong, it’s a problem. We can all relate to dealing with a phone menu and saying, “I want to talk to an agent. I want to talk to an agent,” you’re slamming zero. You’re doing everything you can to actually talk to a person and that’s borne out of frustration.

Scott: Before we leave that subject, your question talking about the tech deployments and the implementations, there’s two more things that I want to go down into the weeds one layer further.

Justin: Please, let’s do it. Let’s do it.

Scott: The bigger the organization, what I have found, these aren’t the most– they’re naysayer-versus-positive attributes, but the problem is they exist. I’m sure you’ve seen it in your career. I can’t tell you how many times when I’ve worked for big corporations or I’ve consulted for large corporations in my consulting firm, you have people in the org chart that want to protect their organization.

Automation means a potential threat to the size of my organization. I can’t tell you how many times that I’ve seen amazing, amazing solutions that could truly revolutionize and do everything the business hopes for, but there is a director who’s very influential that says, “Wow, that cuts my FTE from 250 down to 90. That makes me loomless large on the org chart, so I am against it.” The organization needs to do some soul-searching, and whoever is leading the technology product needs to plan for that and figure out how to manage that because those personalities are known in advance and they become real challenges.

On a more positive note, I think that anybody out there, I don’t care what industry you’re in, you need to have a vendor who will show leadership courage. Don’t let me catch you telling me what you think I want to hear in this proposal. Tell me what I need to know, be honest with me. Don’t let me do dumb things. The RFP process is set up to stretch the truth because there’s a lot of money involved. RFPs, I have mixed opinions on, I help people write a lot of them, I help people respond to a lot of them, but there’s too much smoke and mirrors sometimes.

What I always encourage my clients to look for is, go with a vendor that you really trust, that is really telling you the real deal, and that is being incredibly honest, even when they’re falling on the revenue sword, the answers they’re giving you aren’t necessarily good for the size of the potential business for them. It could be hurting them, but they’re looking for the long-term relationship, not the short-term hit for revenue. I think those two things are very key if we want to talk about getting in the weeds on tech innovation and deployment.

Justin: There’s a larger issue if the egos in your organization are so fragile that they can’t see the forest through the trees and the benefit of bringing in automation to make the business healthier and to make the jobs of the employees that they have better. You’re right. This is another part of the discussion, another bit of the dialogue that needs to happen and might not always be happening for exactly the reasons you mentioned where someone wants to protect their fiefdom or whatever.

Scott: Yes. The good strategy is to keep those people close, and have them on the implementation team. [laughs]

Justin: That’s true. Their true motivations are exposed. The conversation we’re having here is a fantastic one. Scott, I could go back and forth with you all day on this stuff, but I want to land the plane with your thoughts on where the future of support automation is heading specifically in the industries you watch so closely.

Scott: Specifically in mortgage, there is an incredibly bright future. I’m sure, Justin, you see that having gotten through the refi boom, I think there is going to be years upon years of opportunity because there’s been such a lack of investment in mortgage for so many decades that the opportunity of balance is just about everywhere.

Specifically, the trend that I see, and it will continue especially as top line and bottom line three-to-five-year plans, when executives start to feel that very uneasy feeling in their gut, when they look at their three-to-five-year plan saying, “How in the world am I going to meet those top line and those bottom-line objectives?” it’s not going to happen through adding more people. You’re going to be forced to be very savvy on becoming more technology-driven and automating those things that are, in most cases, very low-hanging fruit.

We’re so document-driven. If you spend support automation on documents alone, you’ve got decades of opportunity in front of you, but there’s so much more than that.

If we look at trends today, self-serve is paramount. I’m one that’s a big self-serve fan. I don’t necessarily want to chat online. I don’t necessarily want to call in to anybody. I want you to present me with avenues where I can go in and serve solutions to the inquiries that I’ve got. Support automation I think looms large. I think that trend is in its early stages. With millennials and generation sense, they’re very, very self-sufficient. They spend an inordinate amount of time online and that leads to more self-serve.

I think there is a very, very big opportunity there, documentation and self-serve. Whether it’s on the front end of the loan originations process, they’re very self-serve opportunities and they’re so document-heavy. Clearly on the servicing side of the house, self-serve is– there’s less documentation there. Most documents then come from a lender, not necessarily the borrowers, but self-serve is really paramount on the servicing side of the house. I think those two things alone, self-serve and the document side, major, major opportunities.

Justin: Fully agree. Scott, this has been a wonderful conversation. We’re going to end this show with the way we end every show. That is my quickfire round, where I ask you some questions, you give me the first thing that comes to mind, and I get to learn a ton of new ideas on how to be more productive, books to read, communities to join, et cetera. This is my favorite part of the show because selfishly, it gives me a lot of great things to think about that I can enact in my daily life. What’s the book that you most often recommend to people?

Scott: Oh, I read a lot, and I don’t spend a lot of time recommending, but there’s one that I’m early into right now that’s definitely I think captivating. It’s Where Good Ideas Come From: A History of Innovation by Steven Johnson. It really implores you to say, “Ideas can come from everywhere.” Those Eureka moments don’t usually come from the top down, they come from the bottom up.

I think it really plays well into this conversation, supporting automation. I think of support automation thinking, “For the love of God, give your front line some relief. Pull the mundane things off of them and let them do more value-added things that are enriching to them.” If you think about this book that I just mentioned, there’s a lot of, “Hey, your greatest resource is your front line.” That’s where so many great ideas– That resonates with my career.

I’ve been really strong at being very open-minded, having open ears, and listening to the organization and building solutions that come from the people that are on the front lines. I think the Where Good Ideas Come From book is one that I’d implore people to look at.

Justin: Excellent. What’s the best productivity tip or practice that you have read about or heard, or stumbled upon yourself, and then folded into your daily routine that has made the biggest difference for you?

Scott: Well, I’m embarrassed to say it’s very cliche, but it goes back to Zig Ziglar and separating the big rocks from the small rocks. We can all get mired down in all of our stuff, but every day, I have to reprioritize, “What are the big rocks?” versus, “What are the noise?” It’s very simplistic, but it’s worked for me for many years.

Justin: A huge part of being a productive person is to understand where to start, and “What’s the first bite of the elephant to take?” and really get a clear picture of where you’re going to be able to make the fastest impact. Cliche, as it may be, I think that’s something a lot of people forget, and I’m glad you put it back into our consciousness for a minute here because I think it’s a good one.

If you could recommend any blog, Slack community, LinkedIn group, or real-life group, as we come out of the pandemic, and start to see each other in person again, for people who are interested in bringing technology into the workplace and doing good with it, or support automation, I’m going to let you pick which realm you want to focus on here, but if you could recommend a group for people to join, what would it be?

Scott: I’m going to take the self-serving route here, [chuckles] but with good costs. One of the things that I did not mention about Vendor Surf, Justin, is that not only do we have a great purview of the vendor landscape, but we go to great lengths to have the most comprehensive and robust online calendars of everything going on in the mortgage industry in the credit union space from events, conferences, blogs, webinars, podcasts, training, white papers, E-books, all of those things. We go to great lengths.

It really answers more of a shotgun approach. Everybody is interested in different content. We corral it all and take great pride and great energy, and put in everything we can possibly find out there. We generally have 250 to 500 individual items on these calendarized lists or calendars at any given time. The really cool thing is you can search, you can do keyword searches.

For example, if you’re in sales or risk or underwriting, you can go to the Conferences and Events tabs and put in risk or compliance or whatever, and it’ll only show you those things. We make it simple to find those things. I’ll take the self-serving approach, but it also goes to, it’s very efficient, which we just asked about as well.

Justin: Love it. If there’s one person in business that you could take out for a coffee and pick their brain for an hour, who would it be?

Scott: Who in business? I was going to tell you, Ben Franklin.

Justin: Oh, okay. Let’s go with Ben Franklin then. Why is that? We’d have to do a little bit of time travel or some sort of magic to either go back to his time or bring him here, but why Ben Franklin? I like that one.

Scott: I’ve always said I’ve been a workaholic. God rest their souls, my departed parents always said, “Just do the things in life that you love to do, and just outwork everybody around you. Just do it better and have more passion.” Passion and hard work are the two things that drive me, and what I’ve always looked for in employees or business partners, or vendors. Passion and hard work.

I look at the things that Benjamin Franklin accomplished in his life, all of the ambassadorship and the political things and bringing world order together, yet inventing every hour of the day, it just is absolutely astonishing, much less as other activities where who knows where he found time for. Just a very fascinating individual. I’ve always admired and revered him and all that. His imprint is on this country.

Justin: When I was a kid, I played Ben Franklin in a play that we did in grade school. I don’t remember the play. I don’t remember any of my lines. I just remembered that I was Ben Franklin, and I’m going to have to ask my mom after we get off the phone here if she has the VHS of my performance because now I’m curious.

Scott roller this has been a marvelous conversation. Thank you so much for spending your morning with us. Where can people find out more about you, Vendor Surf and 3W?

Scott: Hit me up on LinkedIn Scott Roller like roller-skating. I would love to engage with you there. Vendor Surf like surfing, vendor surf.com. Easily found there as well. Check us out. We’ve got a lot of great content for those of you that like to consume a lot of very good and direct– The things that I write about, I try to be very entertaining, never a boring read. Find us there. We’d love to chat with you on any topic.

Justin: Scott Roller, thank you so much for coming to The Support Automation Show. You have a wonderful day.

Scott: Appreciate the opportunity, Justin. Thank you.

Justin: The Support Automation Show is brought to you by Capacity. Visit capacity.com to find everything you need for automating support and business processes in one powerful platform. You can find the show by searching for support automation in your favorite podcast app. Please subscribe so you don’t miss any future episodes. On behalf of the team here at Capacity, thanks for listening.