The mortgage industry has been through some tough times in recent years. Margin compression has taken its toll on most mortgage lenders, and many have been forced to find new ways to stay profitable.

What is the state of the mortgage industry?

The most recent Fannie Mae Mortgage Lender Sentiment Survey states that the “majority of mortgage lenders continue to expect near-term profitability to decrease amid rising mortgage rates and declining refinance activity.” Interest rates are predicted to rise, which will directly impact refinance activity. In addition, competition from non-bank lenders continues to be a threat to traditional banks.

According to Jodi Hall, President of Nationwide Mortgage Bankers, “The last three years in the mortgage industry have been very little about mortgages. It has largely been about how do leaders pivot in times of events that are happening.”

What is a margin compression mortgage?

Margin compression occurs when mortgage companies are forced to lower their mortgage rates to compete with other lenders in the market. This can result in a decrease in profit margins and profitability for lenders.

What is the mortgage market profit margin outlook for 2022 and beyond?

Profit margins in the mortgage industry are expected to remain under pressure in the near term as interest rates rise and competition from non-bank lenders continues.

How are top mortgage lenders dealing with margin compression?

There are a few ways that top lenders in the mortgage market are dealing with margin compression:

Focusing on efficiency.

Top mortgage companies are focusing on becoming more efficient to offset margin compression and retain profit margins. This often means automating processes and using technology to streamline the mortgage process.

Reducing expenses.

Another way top mortgage companies are retaining their profit margins is by lowering their expenses. This can be done by cutting overhead costs or eliminating non-essential services.

One of the ways that lenders can improve efficiency and implement cost savings is by using a support automation platform powered by artificial intelligence.

How can support automation help?

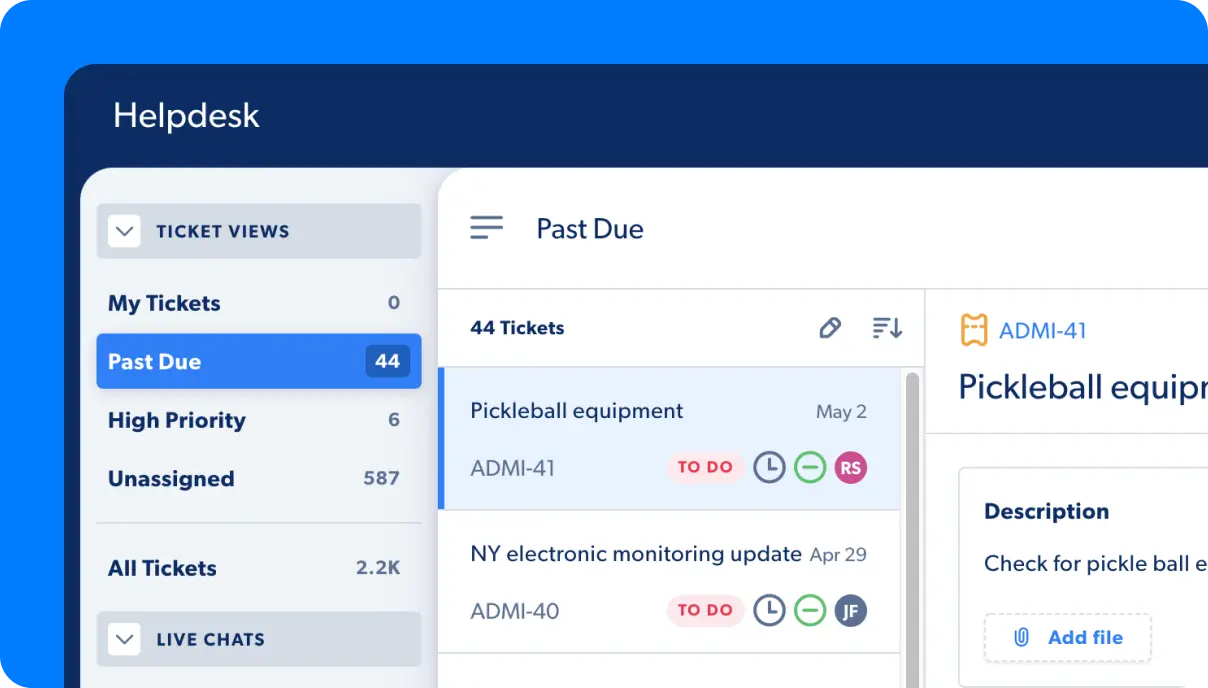

Support automation platforms are used to streamline business operations and improve operational efficiency. For example, a support automation platform can automate customer service tasks and provide mortgage support services, such as responding to customer inquiries or requests.

Support automation can also help lenders process loan applications by automating tasks such as verifying customer information or ordering credit reports.

Additionally, support automation can assist with onboarding new employees. For example, many businesses in the mortgage industry have been using support automation platforms to answer employee questions such as:

- How do I input my PTO?

- How do I submit an expense report?

- What is the status of the housing market in my city?

Chatbots powered by conversational-AI technology can answer these questions in seconds. Employees get their questions answered faster than ever before without tying up the time and attention of their colleagues.

This allows credit unions and other lenders to focus on the company’s strategic vision and build the careers of employees.

Other benefits of using a support automation platform include:

Improved operational efficiency.

Support automation can help improve operational efficiency by automating tasks and processes. This makes sure that none of the steps involved in processing a loan get overlooked. It also frees up time for employees to focus on more critical tasks.

Reduced processing time.

Support automation can also help reduce the processing time for loan applications. With RPA and AI technology, borrower questions can be answered 24/7/365, therefore cutting down on processing time. Support automation platforms can automate repetitive, mundane tasks to help with this as well, including loan fulfillment services and lead generation.

Improved accuracy.

When all of the steps involved in processing a loan are automated, it reduces the chances of human error. This can improve the accuracy of loan approvals and increase customer satisfaction.

Regulatory compliance.

Support automation also helps lenders with regulatory compliance. For example, by automating the ordering of credit reports, lenders can ensure that they comply with Fannie Mae, Freddie Mac, and other regulations.

Conclusion

Shrinking margins and profit margin compression are a firm market trend for 2022 and beyond. Top performers find ways to overcome this hurdle by focusing on efficiency, offering competitive rates, and embracing new technology solutions.

Looking for more industry insights? Check out our Virtual Lunch and Learn on The Return of Margin Compression.

How Capacity Can Help

A support automation platform like Capacity is the ultimate solution to help combat margin compression.

Capacity is a mortgage support automation platform, powered by AI, that supports your borrowers, sellers, and support staff.

Mortgage clients leverage Capacity to scale their support functions, making Capacity available to their entire organization as a self-service option for employees to ask Scenario, Lock Desk, Compliance, Processing, IT and other procedural questions. They also use Capacity to effortlessly tap into key systems like Encompass®, and AllRegs® to provide real-time access to guideline and loan information.