Robotic Process Automation (RPA) can significantly improve the mortgage loan process. This innovative technology executes routine, rules-based tasks without human intervention. It helps eliminate data entry errors, cuts loan processing times, and helps mortgage companies meet regulatory requirements.

Capacity can help by providing connectivity to regulatory and compliance databases when it comes to staying on top of regulatory requirements. Here are a few suggestions on what types of mortgage processes can be automated with RPA and the benefits.

User Assignment and Workflow Automation

There are several use cases for AI in the mortgage industry. The number of touchpoints in the mortgage process can be overwhelming. Loan officers, processors, underwriters, and closing agents are a few of the players involved. This process is not always linear. Many of these people must interact regularly and share information back and forth for each loan. Manually coordinating the process and handoffs is very time-consuming and increases the risk of missing critical deadlines.

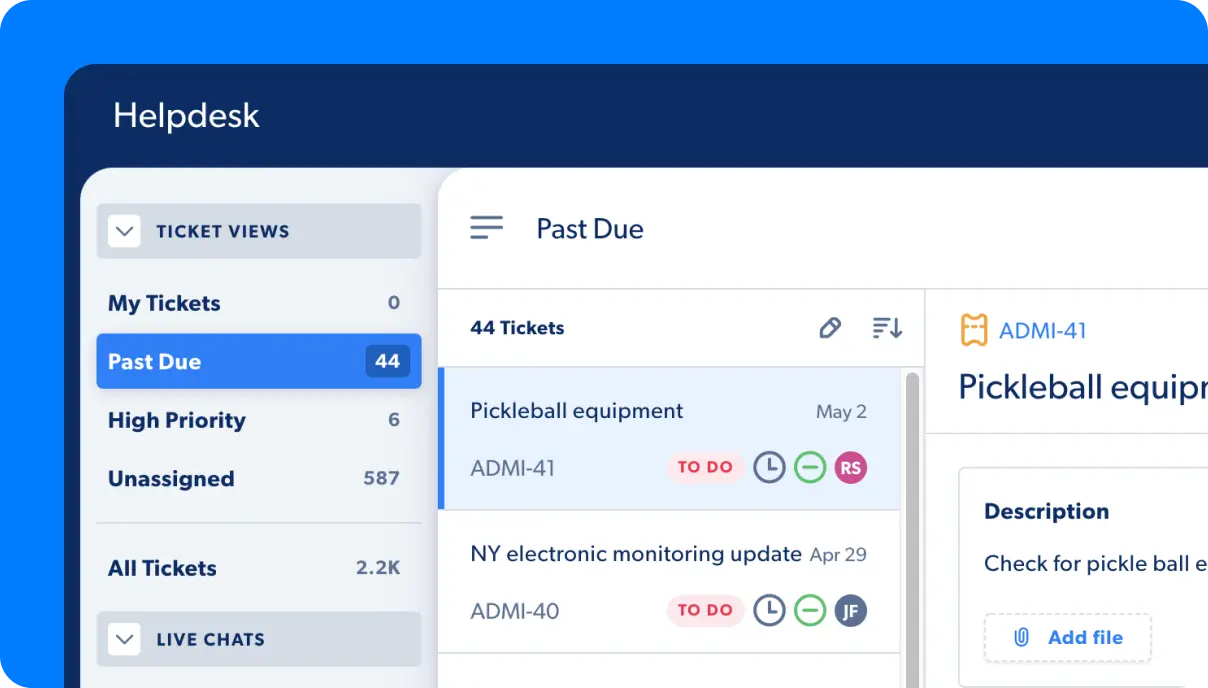

Capacity features intuitive workflow automation to handle these critical handoffs, so lenders can focus on other important tasks.

Automation can take over these handoff tasks as the virtual project manager. It can automatically detect when a loan needs to move between departments based on specific conditions or rules set by the lender. RPA can keep track of due dates, raise alerts and notify the correct individuals as necessary. Additionally, an RPA tool can automatically route the loan package as required between each touchpoint.

Mortgage Origination

According to Statista, as of Q1 of 2021, the total mortgage originations in the United States were approximately 1,094 billion U.S. dollars. This long process of loan origination can be full of errors. These errors slow down review and approval times, frustrating the lender and borrower. Mortgage origination is the perfect example of what can be automated with RPA.

Robotics tools can integrate with a company’s website or Loan Origination System (LOS) to automate data input for the loan. It can walk the customer through the entire application input process. RPA can detect missing information, validate data entry for accuracy, and collect documents required to apply. Support automation platforms, like Capacity, are equipped to collect borrower information on your website through a conversational AI-powered helpdesk. A typical workflow could be as follows:

- Loan Origination System receives the customer loan application (Capacity is equipped to run in parallel to your LOS.

- The bot runs a credit check.

- The bot then attaches the credit report to the application.

- RPA extracts the data from the credit report and inserts it into the appropriate fields in the LOS.

- The bot then moves the application to the next stage and notifies the customer that the application has been received.

Mortgage Underwriting

Missing information is one of the most common challenges underwriters face. They need to know the applicant provided a complete set of information before diving into the details. Even one small missing detail can delay approval. Although loan officers check this information before sending it for review, omissions happen. Implementing RPA in the origination process could help avoid this issue.

A few additional items which would benefit from automation include:

- Validating Income Discrepancies: Underwriters must verify all financial information. Sometimes this data does not match what the borrower stated. The RPA can cross-reference the necessary documents to validate that the income provided is accurate.

- Credit Analysis: An application may appear to meet all requirements. However, that may not be the case. Rather than the underwriter needing to validate this information, RPA can perform the necessary verifications.

- Funding Issues: Underwriters need to see clear evidence of all funds used for the transaction. This includes evidence of funds, the exact amount, and where it originated. Using RPA technology can automate this step for the underwriter.

Fraud Detection and Analysis

National Mortgage News reports that when it comes to fraud prevention, many report the challenges as address verification (42%), email or device verification (37%), phone verification (36%), and customer experience conflicts (34%). Identifying, combating, and curbing fraud through conventional automation can be challenging. The level of sophistication grows daily. RPA is an invaluable asset in these situations. This technology can monitor various systems to identify unusual activity and raise alerts to the appropriate parties.

When unusual activity is identified, a large sum of information is required to begin an investigation. The longer it takes to gather it, the greater the potential loss. RPA speeds up investigations by pulling together the necessary data in a short amount of time. RPA technology helps clear up time for lenders by focusing on the quantitative aspect of the investigation.

This technology is useful for complying with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. RPA-based solutions track all actions by employees and customers to compile a complete audit trail. This makes it easy to locate when required for KYC or AML verification. Fannie Mae helps keep up with and identify common fraud schemes.

How Capacity Can Help

The complexity of the mortgage lending process lends itself well to robotic process automation. It is a technology that removes the human element of the process to save time, reduce human error and detect fraud. More importantly, it is invaluable to helping companies stay on top of regulatory requirements.

Capacity is an AI-powered automation platform, offering plenty of use cases throughout the mortgage process. Request a demo of Capacity to learn more about what can be automated with RPA and how we can help your company see the many benefits today!