According to a Mortgage Bankers Association Report, the costs of mortgage origination have been slowly rising for over a decade. Mortgage decision-makers need to find solutions to reduce expenses to continue providing competitive mortgage rates and fees. One solution to combat rising costs to increase profits is lending automation.

Total loan production costs are rising.

The total cost of producing a loan includes many different variables, such as:

- Compensation

- Commissions

- Technology

- Equipment

- Occupancy

- Corporate allocations

While reducing any one cost can reduce the total loan cost, it’s essential for company leaders to understand the major costs associated with loan production. Identifying the most significant areas of expenses can help find ways to reduce spending.

The two major costs of mortgage production are compensation and commission.

Mortgage companies should use extreme caution when considering reducing commissions. Hiring top sales agents can exponentially increase loan processing and profits. There’s a lot of competition for these top-earning agents, so mortgage companies who lower their commission rates aren’t likely to draw in the best talent.

Compensation, however, has many elements that can be trimmed down. Companies can reduce compensation without reducing the hourly rate or salary of their employees, which isn’t always the right approach. Instead, decision-makers should improve operational efficiencies to make the most of their employees’ time.

Training and hiring quality employees can only speed up the loan process so much. Instead of pressuring workers to optimize their time and perform more throughout the day, mortgage companies can use the latest automation technology to increase efficiency and loan processing capabilities.

Support Automation can speed up the process.

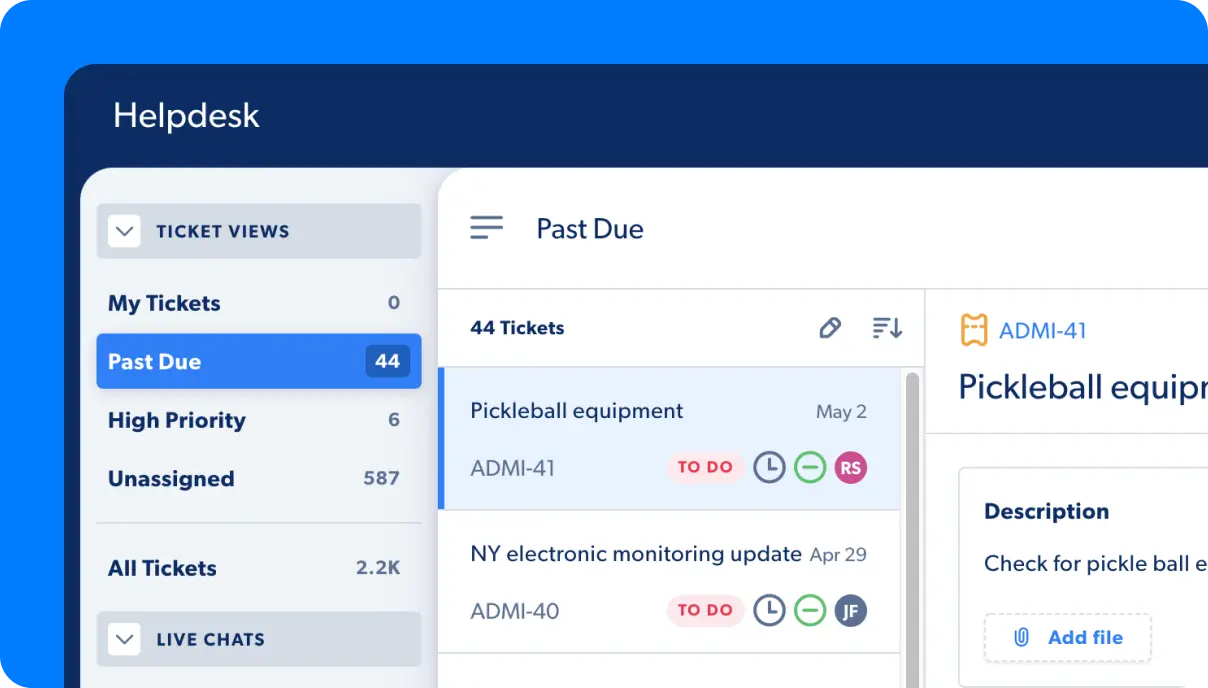

Lending automation offers many distinct benefits for mortgage companies. A streamlined system that’s easy to navigate can reduce work hours from the front- and back-office employees. It can also review tasks and answer repetitive questions throughout the loan process.

The result is a dynamic mortgage team that focuses on high-impact tasks, while an automation platform handles the time-consuming, repetitive ones. Support automation creates opportunities for teams to handle increased volumes of mortgages with greater levels of accuracy.

A support automation platform can manage workflows for lenders and borrowers

Capacity is equipped with a workflow management tool and knowledge base to guide employees through the loan origination process. Chatbot functionally answers questions from employees and borrowers to improve the accuracy of every step in the process. This expansive, customizable knowledge base powers the machine learning aspect of Capacity to reduce the amount of time to answer questions and train employees.

A support automation platform isn’t just about tracking the process of a mortgage application. This AI-powered end-to-end service offering can also take on repetitive, time-consuming tasks throughout the workflow. Once a loan officer is assigned to a specific mortgage application, these steps can be automatically fulfilled by Capacity at the appropriate times in the workflow:

- Email borrower documents

- Alert loan officers of signed applications

- Select the appropriate form for all parties to sign

- Share e-signed documents with relevant parties

Thanks to Fannie’s Form 1003 mortgage application, the information lenders need to know is easily accessible. A support automation platform, like Capacity, can evaluate applications, make recommendations, and request any missing information from loan professionals or borrowers.

Automation can lead to increased profits.

These features of a lending automation platform can have real-world impacts on a mortgage company’s bottom line. Two key ways that a support automation platform can help the mortgage industry include reducing the time spent on applications and increasing the amount of applications teams can handle.

A streamlined workflow saves time.

A mortgage broker or loan officer shouldn’t spend hours searching for the right form, checking the status of an application, or sending out reminder emails. All of these tasks can be and should be, automated for an efficient workflow.

Streamlining the workflow can increase profits by reducing the following costs:

- Overtime hours

- Number of professionals required for each mortgage

Close more loans, faster with lending automation.

Some companies choose to downsize after streamlining the loan origination and loss mitigation processes. Others choose to invest the extra hours and offer more lending options or take on more loans.

An AI-assisted lending process can increase profits, so mortgage companies can offer more competitive mortgage application fees. This investment can increase the number of applications, which companies can now handle thanks to automation-assisted lending.